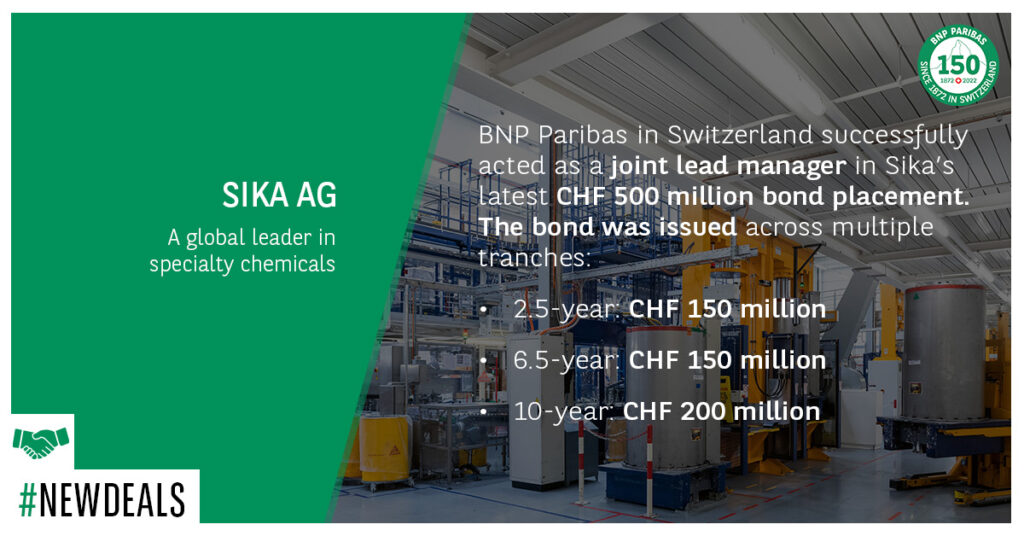

BNP Paribas in Switzerland successfully acted as a joint lead manager in Sika’s latest CHF bond placement, showcasing its strong position in helping domestic corporates achieve attractive funding.

Deal overview

Sika successfully placed a new triple-tranche transaction comprising a 2.5-year, a 6.5-year, and a 10-year tranche amounting to a total of CHF 500 million. BNP Paribas acted as Bookrunner alongside UBS and Zürcher Kantonalbank:

Following Sika’s successful dual-tranche issuance last year, where BNP also acted as joint-lead manager, the Company decided to revisit its home market on the back of favourable market conditions.

Building on its strong reputation in its home market, Sika opted for an intraday execution strategy. As there was only one other financial issuer active in the CHF market, Sika was able to capture investors’ full attention.

A slight skew in terms of investor demand towards the longer tranche enabled Sika to tighten pricing throughout the process and finally price 5bps inside IPT levels in the 10-year tranche and 3bps in the two shorter tranches.

The three tranches priced with the following final terms:

- 2.5-year CHF 150 million at SARON MS+57bps, implying a 0.750% coupon

- 6.5-year CHF 150 million at SARON MS+67bps, implying a 1.100% coupon

- 10-year CHF 200 million at SARON MS+80bps, implying a 1.350% coupon

Asset Managers dominated the allocations across all tranches followed by Insurance Companies and Private Banks.

About Sika

Sika is a specialty chemicals company with a globally leading position in the development and production of systems and products for bonding, sealing, damping, reinforcing, and protection in the building sector and automotive industry. The company operates in 103 countries and has over 400 production sites. Sika will use the proceeds from this bond placement for general corporate purposes, including refinancing existing financial obligations.

BNP Paribas in Switzerland is proud to have acted as Active Bookrunner on Thermo Fisher Scientific’s landmark CHF 1.425 billion bond issuance, executed across multiple tranches:

- 1.5 year: CHF 410 million

- 4 year: CHF 315 million

- 8 year: CHF 350 million

- 12 year: CHF 215 million

- 20 year: CHF 135 million

This transaction represents the largest CHF-denominated bond offering ever completed by a US corporate, reinforcing the strength of both Thermo Fisher Scientic’s credit profile and the enduring appetite of Swiss investors.

This deal marks the fourth time BNP Paribas has supported Thermo Fisher in an Active Bookrunner role and the second consecutive CHF mandate for the company—further evidence of a trusted and growing partnership.

The successful outcome of this issuance demonstrates BNP Paribas’ ongoing commitment to supporting its clients with innovative and impactful capital markets solutions. It also highlights our deep expertise in the Swiss franc bond market and our ability to connect global issuers with robust investor demand.

We are grateful to Thermo Fisher Scientific for their continued trust and extend our thanks to all teams involved for their dedication.

This transaction represents the largest CHF-denominated bond offering ever completed by a US corporate.

- BNP Paribas continues to build out its Corporate Coverage franchise in Switzerland

- Michael Keller is appointed Head of Corporate Coverage Switzerland, effective March 1st, based in Zurich

BNP Paribas is very pleased to welcome Michael Keller who is joining our Corporate & Institutional Banking (CIB) in Zurich.

Michael brings over 30 years of experience in the Banking Industry in Switzerland, having spent the past 24 years at UBS Group in various leadership roles in Corporate Banking.

He last served as Managing Director in the Corporate & Institutional Clients division, in charge of relationship management for multinational clients in Switzerland. He has a profound experience in Swiss Corporate Banking and has been involved in some of the most important and complex financing and advisory transactions in the last 10 years.

Michael is a Swiss Certified Banker and completed the General Management Program at Harvard Business School and the Sustainability Leadership Programme at INSEAD.

“As we are successfully completing our 2025 CIB Switzerland Growth Plan and are setting our 2030 Growth Ambition, Michael will be instrumental in our next phase of growth. With his team of exceptional bankers he will be driving Corporate Coverage, delivering our unique value proposition to help Swiss companies compete and grow globally and in Switzerland.”

Enna Pariset, CEO of BNP Paribas (Suisse) SA and Head of Territory for BNP Paribas Group in Switzerland

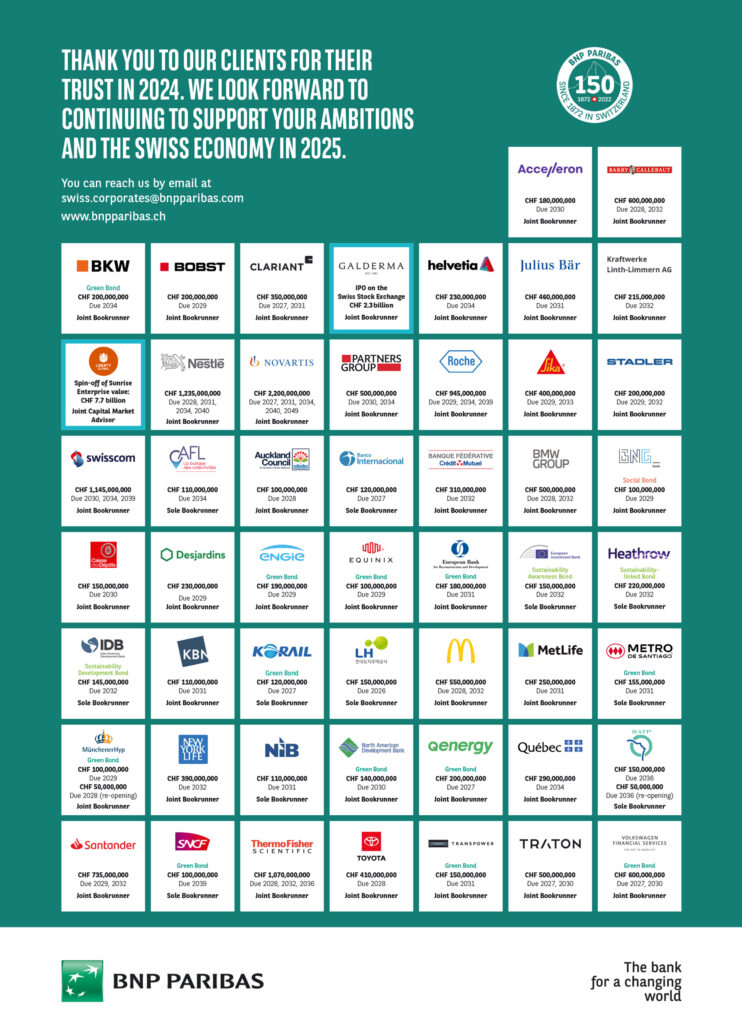

2024 marked a year of exceptional performance for BNP Paribas in Switzerland, solidifying our position as a key player in the Swiss economy.

Thank you to our clients for their trust in 2024. We look forward to continuing to support your ambitions and the Swiss Economy in 2025.

BNP Paribas’ annual flagship Sustainability Forum returned for its 9th edition, uniting clients and partners to tackle the pressing challenges and opportunities surrounding climate, biodiversity and social issues. With events hosted across the globe, the forum serves as a dynamic platform for meaningful engagement and discussions, shaping the future of the economy and society.

The Sustainable Future Forum 2024 is meant to explore the latest innovations in the low carbon transition, navigate the regulatory landscape and look at solutions to address the biodiversity crisis. In Switzerland, BNP Paribas actively supports a more sustainable economy, promoting social and environmental responsibility for a better future.

In this context we recently held an interactive roundtable on the topic of “How investors navigate the challenging world of ESG products” in Zurich, together with our experts Loic Grenier (Corporate Coverave BNP Paribas in Switzerland), David Reynolds (Managing Director – ESG Advisory Team BNP Paribas), and Sébastien Soleille (Global Head of Energy Transition and Environment BNP Paribas).

We were delighted to welcome partners like the Swiss Sustainable Finance and the IUCN (International Union for Conservation of Nature), alongside our clients, for this impactful roundtable. By fostering collaboration and knowledge exchange, it reinforces our commitment to supporting clients in navigating the complexities of ESG trends and energy transition.

BNP Paribas in Switzerland recently hosted together with Zanders, a treasury and risk consulting firm, a Cash Management Conference dedicated to Corporate Treasury, at the historic Zunfthaus zur Waag in Zurich.

The conference brought together 70 corporate clients and featured two engaging panel discussions, moderated by Kamel El Fedil, Head of Cash Management Switzerland, and Tobias Westermaier, Head Corporate Advisory Switzerland at Zanders. They explored how AI can be integrated in decision-making and shape the future of Treasury management.

Highlights from the panel discussions

Panel 1: How AI can help treasurers make data-driven decisions to enhance efficiency?

Experts delved into the transformative role of AI in Treasury, demonstrating how advanced tools can enable treasurers to optimize workflows, improve decision-making, and anticipate financial risks.

Panel 2: The future of treasury

The second discussion explored emerging trends, challenges, and opportunities in Treasury management.

A Platform for Collaboration and Innovation

Beyond the discussions, this conference offered a unique opportunity for treasury professionals to connect with peers, share insights, and explore solutions to tackle emerging challenges.

“At BNP Paribas in Switzerland, we are committed to helping our clients navigate the changing era of Corporate Treasury with confidence and purpose,”

Kamel El Fedil.

This event underscores BNP Paribas’ dedication to empowering our clients with the expertise, tools, and insights needed to thrive in a fast-evolving treasury landscape.

BNP Paribas is pleased to have acted as Joint Capital Market Advisor to Liberty Global on the successful spin-off of Sunrise on the SIX Swiss Exchange.

With an enterprise value of CHF 7.7 billion (USD 8.7 billion), this milestone transaction reaffirms Sunrise’s position as a leader in Switzerland’s telecom market. As the largest US-Europe spin-off in a decade, it highlights both the strength of the Swiss market and BNP Paribas’ expertise in delivering innovative, cross-border solutions for complex transactions. This transaction reflects BNP Paribas’ continued commitment to supporting our clients grow and deliver value to their shareholders.

Congratulations to Liberty Global, Sunrise and all those involved in making this landmark deal a success!

With BNP Paribas (Suisse) SA acting as Joint Lead Manager, BMW International Investment B.V., guaranteed by Bayerische Motoren Werke Aktiengesellschaft, marked a successful comeback to the Swiss franc market after five years of absence.

Overview of the Deal

The renowned German auto manufacturer, a valued and long-standing client of BNP Paribas, successfully raised CHF 500 million through a dual-tranche bond offering, underscoring strong investor demand for BMW’s well-established brand. The transaction generated substantial interest from the outset, leading to a healthy order book that enabled BMW to secure CHF 500 million, comprising a 4-year tranche of CHF 300 million and an 8-year tranche of CHF 200 million.

This transaction is not only a testament to BMW’s appeal in the Swiss market but also highlights the attractiveness of the Swiss franc market as a funding platform for international issuers. For BNP Paribas, this deal reaffirms our deep commitment to our clients and our unmatched expertise in navigating the Swiss financial landscape. Our consistent top-three ranking in this market reflects our dedication to driving impactful financial solutions and contributing to the growth of Switzerland’s capital markets.

We are delighted and honoured to have accompanied BMW in successfully returning to the Swiss franc market, and to have strengthened our relationship with one of the automotive industry’s most respected names.

BNP Paribas in Switzerland has achieved a significant milestone by securing the 2nd position in the 2024 Trade-Finance Share Leaders ranking, as confirmed by the annual Coalition Greenwich European Large Corporate Trade Finance study, based on more than 450 total respondents.

Coalition Greenwich is a leading global provider of strategic benchmarking, analytics and insights to the financial services industry.

This recognition underscores BNP Paribas’ strong and growing presence in the Trade Finance sector across Europe. With 48% market penetration, BNP Paribas remains the leading Trade Finance provider in Europe, achieving top positions in Belgium-Luxembourg (85%) and France (89%). The study places the bank at no.2 positions in Switzerland and the UK at no.3 in Italy.

“This first appearance on this podium with a 2nd spot is the result of a continuous team & stakeholder effort, with a special thanks to Corporate Coverage as well as to our Trade Operations who together support our growing franchise in Switzerland and beyond.”

Laurence Lali-Beaucage

Head of Global Trade Solutions Switzerland

- BNP Paribas continues to build out its Global Markets franchise in Switzerland

- Oliver Kok is appointed Head of Cash Equities Switzerland, effective March 11 and is based in Zurich

BNP Paribas is pleased to welcome Oliver Kok as Head of Cash Equities Switzerland.

Based in Zurich, Oliver will contribute to growing the market share of

BNP Paribas and strengthening its cash equity franchise, supporting the great momentum of the Bank in equities after the integration of Deutsche Bank Global Prime Finance and Electronic Equities business in 2019 and the integration of BNP Paribas Exane teams in 2023.

Oliver joins BNP Paribas from Credit Suisse, where he was Managing Director, covering Swiss institutional clients in Cash Equities sales and responsible for the Swiss Equities franchise. He obtained his Bachelor of Science from the Maastricht University.

« This appointment is in line with our Growth Plan for CIB and strengthens further our end-to-end equities platform in Switzerland. Our DNA is to support the Swiss economy and its debt and equity capital markets. »

Enna Pariset, CEO de BNP Paribas (Suisse) SA et Head of Territory pour le Groupe BNP Paribas en Suisse