2020 BNP Paribas Global Entrepreneur Report

The 2020 Global Entrepreneur Report by BNP Paribas Wealth Management gives an insight on what Elite Entrepreneurs across 19 countries think about sustainable investments, their top priorities and whether their actions actually matched their thinking.

Key Take-Aways

Sustainability has become core in entrepreneurs’ financial commitment accross all regions

- Almost half of this Entrepreneurial audience already have sustainable investments.

- 70% are more willing to invest sustainably than they were 18 months ago, rising to 75% for Millennials.

- On average, these impact seekers are prepared to quadruple their financial commitments to sustainable investments over time.

- The primary reason entrepreneurs like these investments is because they represent a way for them to use their wealth to embed their personal and family values.

Climate change action: the number one united nations sustainable development goals (UNSDG)

- 33% of entrepreneurs choose climate action as a top five UNSDG theme among the 17.

- Climate change action is the priority in Europe; in the US, access to affordable clean energy; in Asia, promoting inclusive growth.

IMPACT-SEEKERS WANT THE WEALTH MANAGEMENT INDUSTRY TO PLAY ITS PART AND PROACTIVELY DISCUSS RELEVANT SUSTAINABLE INVESTMENT OPPORTUNITIES, INFORMATION AND ADVICE TO ACHIEVE THEIR IMPACT OBJECTIVES.

Vincent Lecomte, CEO of BNP Paribas Wealth Management, commented:

“Expectations are different from one region to another, but entrepreneurs all want to contribute and use their wealth to leave a positive mark on society. The Covid-19 pandemic has also accelerated sustainable investing: 64 % of investors believe the coronavirus crisis is a tipping point for ESG investment. The wealth management industry has a major part to play in providing the right level of information, transparency and solutions to support this entrepreneurial commitment. Going one-step further this year, we recently launched our new, game-changing sustainability rating methodology across all asset classes, putting us at the forefront of the private banking industry. Thanks to this methodology, our clients can compare the level of sustainability of the investments we recommend. By the end of 2021, all of our recommended universe will be rated.”

Anne Pointet, Deputy CEO of BNP Paribas Wealth Management, added:

ESG considerations can enter investment strategy and portfolio construction in many different ways. There is an important focus today on E and S, but G (Governance) is sometimes a little forgotten. We are convinced at BNP Paribas Wealth Management that strong governance can drive higher long-term returns, crucially while reducing portfolio risk.”

BNP Paribas Wealth Management launches new sustainability rating methodology : the clover rating

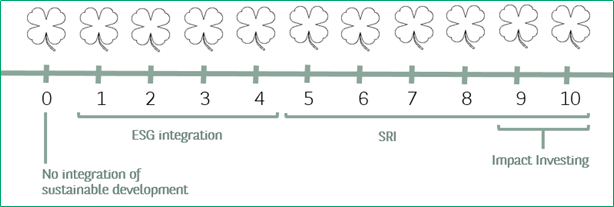

- This clover rating measures the sustainability level of all recommended financial instruments, whether responsible or not.

- A consistent approach, with criteria adapted to all asset classes, to position the sustainability level on a single rating scale from 0 to 10 clovers.

- “Sustainable” starts at 5 clovers, the minimum for sustainable mandates and advisory.

- It allows clients to compare all financial instruments (funds, equities, bonds, ETFs, etc.) in their portfolio in order to align their holdings with their sustainability objectives.

By the end of 2021:

- 100% of the recommended universe rated, compared to 80% today.

- More than 1/3 of the recommended universe will be sustainable, of which at least 50% of recommended funds will be SRI.

The research program was undertaken by Aon Client Insight and involved a survey programme with 1,132 High Net Worth and Ultra-High Net worth entrepreneurs spanning 19 countries representing an average investable wealth of $18.2 billion.