BNP Paribas Wealth Management reinvents its client experience

BNP Paribas Wealth Management reveals its new Client Experience co-created with Clients and Fintechs.

Enhancing the existing innovative digital solutions, these new services and functionalities have been live since December 2016 and will be continuously reinforced in the coming months.

An international ambition driven by the will to create a new Wealth Management experience

Clients, private bankers and specialists from BNP Paribas Wealth Management united around the same project and designed this new client experience during 4 innovation sessions in Brussels, Rome, Luxembourg and Hong Kong. The project was to create a new wealth management experience fit for a world where digital interactions have come to enhance human ones. During a second step, tightly knit “pizza teams” worked in 3 factories (incubators) in Europe and Asia to design and create innovations that would reflect this new client experience. These factories are specially conceived and equipped to encourage and foster rapid development of solutions for the bank’s clients. In total, almost 200 people from diverse backgrounds contributed to reinventing this client experience through digital solutions.

“Our ambition was to define the best use of technology to bring our clients to the next level of experience they had helped to define. Each of these new services and technologies is improving a part of the client journey, be it starting a relationship with us, creating or seizing investment opportunities or reaching the highest level of security,” explains Vincent Lecomte, Co-CEO of BNP Paribas Wealth Management. “Our clients are already experiencing the changes and there are even more to come.”

Some of these innovations were developed in close cooperation with Fintechs.

The client lifecycle drives all Wealth Management initiatives

At the heart of the Client Experience transformation, there is the strong will to create a new form of wealth management that adapts the banking services to every aspect of a client’s life.

“We learned a lot by working differently on this ambitious project, and received extremely positive feedback from both clients and teams who worked together on brainstorming, conception, production and testing sessions. It was very important for us to integrate clients in this innovative process and we hope these new digital solutions will generate the same enthusiasm for all our clients,” added Sofia Merlo, Co-CEO of BNP Paribas Wealth Management.

Disruptive new services & functionalities

Since December 2016, new services and functionalities have been progressively launched in various markets around the globe. All these initiatives are aimed to be fully embedded in the client’s life and are giving clients the power to manage the banking relationship the way they want to (choosing preferred channels, or adopting new ways to secure information, personalizing content, information…).

Client Experience in motion : focus on three new services

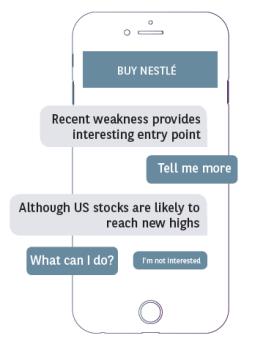

myAdvisory An Investment Manager in the Client’s Pocket

myAdvisory boosts clients’ investments management and provides personalised financial advice directly via a smartphone.

Clients can…

Clients can…

- Receive recommendations aligned with their personal guidelines

- See and analyze their portfolio and relevant metrics

- Define their contact strategy to avoid over or under solicitation

- Place an order based on a recommendation provided by the bank on their smartphone

- Connect to myAdvisory in a secured way to keep their data safe

- Give their feedback to enhance service

- Contact their private banker to ask for more information or set up an appointment

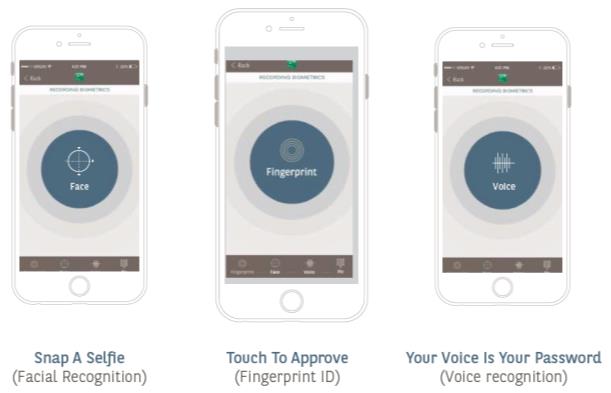

myBioPass A Unique Key to Access BNP Paribas Wealth Management Services

myBioPass enables clients to easily access their online banking services using biometrics.

Clients can…

Clients can…

- Log into myWealth and Web Banking on their tablet using their biometrics (face recognition) and their smartphone as a key

- Validate transactions using their biometrics (fingerprint + voice recognition) and their smartphone as a key.

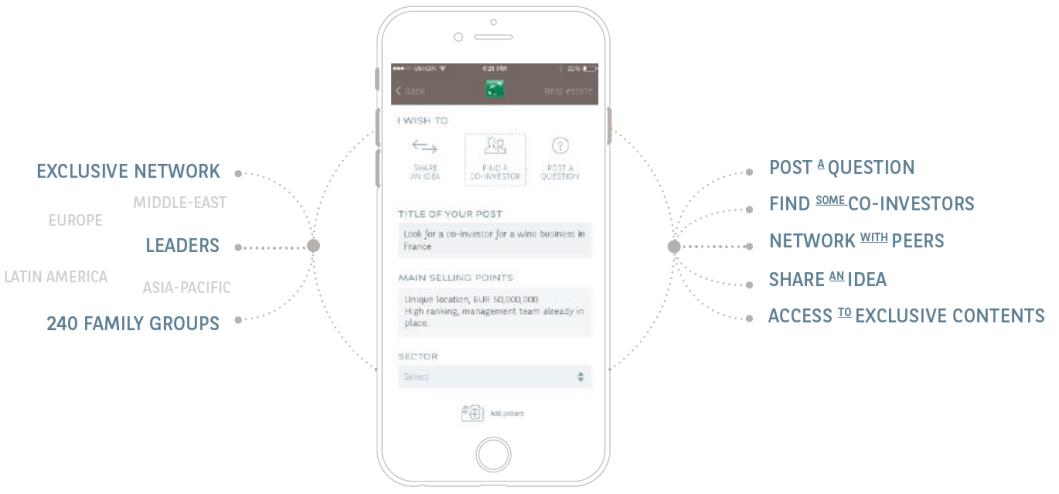

THE LEADERS’ CONNECTION Sharing and Engaging with Peers

The Leaders’ Connection is a digital platform available on smartphone and tablet that allows BNP Paribas Wealth Management to connect eligible investors to facilitate co-investments and give them the opportunity to share their views on exclusive private investment opportunities.

Clients can…

Clients can…

- Have direct access to peers, build a trusted circle along the way and enlarge their international network.

- Look for a co-investor among their peers to collaborate, raise questions and share ideas in a secure way.

- Connect privately with a peer in a secure way.

- View sell side mandates of private opportunities published by BNP Paribas and contact the bank.

- View the history of all co-investment opportunities and questions/posts from the community.

- Access the content of the app offline.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management (wealthmanagement.bnpparibas) is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimizing and managing their assets. The bank has €341 billion worth of assets under management (as of September 2016).

Servane Costrel de Corainville

Press Contact – BNP Paribas Groupe

+ 33 6 74 81 98 27