BNP Paribas Asset Management lists its low carbon ETF in Switzerland

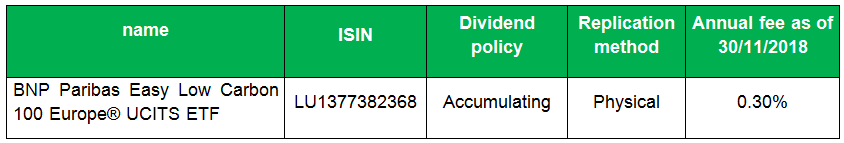

BNP Paribas Asset Management confirms its commitment to low carbon finance on the 10th anniversary of its BNP Paribas Easy Low Carbon 100 Europe® UCITS ETF and strengthens its offer in Switzerland with the listing of this ETF on the SIX Swiss Exchange on 11 December 2018. Launched in October 2008, BNP Paribas Easy Low Carbon 100 Europe® UCITS ETF was the first low carbon fund, offering investors an effective investment solution to reduce the carbon footprint of their investment portfolio. It replicates the Low Carbon 100 Europe® NR, an index created and published by Euronext that contributes to financing energy transition by redirecting investments towards those companies that are most active in reducing their carbon emissions and that offer the products and services required for energy transition to occur. Euronext recently announced the exclusion of fossil fuel companies following its December rebalancing of the index.