Conducted by Scorpio Partnership for BNP Paribas Wealth Management, the private assets survey explores the behaviours and trends of private investors and non-investors in Private Equity and Real Estate (PERE) funds. The report, which polled 337 High Net Worth Individuals (HNWIs) with more than USD5 million in investable assets across nine countries in Europe, Asia and the Gulf region, shows:

- On average, active investors in Private Equity and Private Real Estate funds hold 16.3% of their portfolio – their #1 asset allocation in their wealth while holding 15.8% in cash and a further 15.3% in stocks/equities

- 50% of HNWIs are willing to invest at least USD 500,000 in 2018 in private equity funds and 40% of HNW non-investors in Private Equity or Private real Estate funds are likely to invest into these asset classes in the near future.

- For more than a third the benefit of these investments is to balance their wider portfolio; with a similar proportion led to consider this asset class by their Relationship Manager.

Study participants consisted of Millennials under 35 years old, Generation X / Generation Y and Baby Boomers. They confirm their increasing confidence in Private Equity and Private Real Estate solutions and underline their need for information and advice: Over 60% of HNW individuals indicate that they were either familiar or extremely familiar with Private Equity and/or Private Real Estate Solutions. One-third of HNW non-investors has never been introduced to these investment opportunities and rely mainly on their private banker and financial adviser for access.

“Over the past 12 months, we have seen a significant pick up in clients’ appetite for Private Equity and Private Real Estate funds. In this persistently low interest rate environment, investors are looking for diversification and double digit returns to optimise their portfolio’s risk return profile. We are aiming to raise almost a billion euros in 2018”, underlines Claire Roborel de Climens, Global Head of Private and Alternative Investments at BNP Paribas Wealth Management “The Private Market funds we are planning to launch over the next six months will allow our clients to fully benefit from exposure to the real economy in Europe, Asia or US where on the one hand, high-performing companies need to develop further and on the other, value-added Real Estate strategies can be implemented. These strategies respond to clients’ demand and are differentiating for the ongoing development of BNP Paribas Wealth Management’s activity.”

Private markets characteristicsRecognised as a profitable, illiquid and long-term investment with low volatility contributing concretely to the growth of the real economy with high return potential. These funds enable clients to diversify their wealth through different strategies (LBO, growth, value-added real estate…) and geographies (USA, Europe, Asia). In Private Equity, clients invest indirectly in unlisted companies at different stages of growth, by supporting their managers’ development strategies. In Private Real Estate, clients also like to invest in tangible real assets where value creation is implemented by local experts. |

To know more

- Download the 2018 Private Assets Survey

- Watch the video “How Do You Create Value In Private Equity“

- Visit our website “Everything you always wanted to know about private equity but were afraid to ask” More findings on the “Voice of Wealth” app on the App Store or on Google Play Store

- Discover The Report on International Real Estate

A year ago, BNP Paribas Wealth Management announced its new “Client Experience”, created jointly with clients and in partnership with fintechs.

We launched the Client Experience programme to serve and satisfy our clients in a personalized, seamless and secure way by adapting all of our services to all aspects of the client’s life, said Vincent Lecomte, Co-CEO of BNP Paribas Wealth Management.

Nearly 400 clients, private bankers and experts from BNP Paribas Wealth Management came together in three factories (incubators) in Europe and Asia to combine their knowledge and come up with innovations in line with this new client experience.

We have adopted new ways of working with agile, multidisciplinary teams who have worked together in partnership with bank clients – often entrepreneurs as part of a co-construction approach, added Sofia Merlo, Co-CEO of BNP Paribas Wealth Management

Ten digital services have already been made available to BNP Paribas Wealth Management clients and four new features (MVPs) will be launched in the coming months.

We are now rolling out all these innovative solutions in our key markets, added Vincent Lecomte, Co-CEO of BNP Paribas Wealth Management

A Unique Digital Offering for Wealth Management Clients

myWealth is the digital platform available for international clients of BNP Paribas Wealth Management, and offering a wide range of services :

-

- Secured log-in through 3 different biometrics

- Tailor made on-line advisory and investment capabilities

- Secure Chat and Video Conferencing

- Electronic Vault with Secure Storage and exchange of documents

- Personalized newsfeed aggregating sources of information

All these features will progressively be available for clients in all our international sites. myWealth offers one of the smoothest and most sophisticated digital experience for wealthy clients, states Mariam Rassaï, Head of Client Experience and Digital Transformation at BNP Paribas Wealth Management.

Other digital services enrich this ecosystem, such as Youmanist, offering lifestyle content, or The Leaders’ Connection, allowing co-investment with other professional investors.

New 2018 MVPs (Minimum Viable Products)

myWealth is enriched with 4 new MVPs :

- myMeeting: To enrich meetings and benefit from skills of both private bankers and specialists

- myVirtualAssistant: To provide 24/7 access to the bank

- myEagleVision: To have an aggregated vision of your wealth

- myFeedback: To quickly suggest improvements and express needs

About BNP Paribas Wealth Management

BNP Paribas Wealth Management is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €358 billion worth of assets under management (as at 30 September 2017) and was elected “Best Private Bank for Entrepreneurs” in 2016 and 2017.

Press contact BNP Paribas Wealth Management

Servane Costrel de Corainville + 33 (0)1 42 98 15 91 / +33 (0)6 74 81 98 27 servane.costreldecorainville@bnpparibas.com

Press contact BNP Paribas Wealth Management

Servane Costrel de Corainville

Press Contact – BNP Paribas Wealth Management

+ 33 6 74 81 98 27

2017 has been quite a year with an improving global economy. Financial markets pursued their positive trend and needed less support from central banks. Where to invest in 2018?

For 2018 BNP Paribas Wealth Management expects the economy to pursue its 2017 trend with a rising inflation. Florent Bronès, Chief Investment Officer, and his team give their insights on the future trends, hot topics and where to invest for this New Year to come.

Innovation is key

Among the megatrends themes suggested, Millenials have their part through innovative sectors such as Virtual Reality and Augmented Reality Database management, Big Data and industries integrating new ways of consumption.

Sustainability and responsability, always

Sustainable and responsible investments are also part of the key trends for 2018. Infrastructure and urbanization are defined as a global trend, essential for emerging markets and major for renovation in developed countries. Healthy consumption and sustainable production methods also have quite an appeal through responsible investment.

To know more about BNP Paribas Wealth Management’s solutions for investing in 2018, read the full article.

The first ‘BNP Paribas Global Prize for Women Entrepreneurs’ awarded to Dr. Laura Melis for her work and commitment towards improving her patients’ care experience in the medical sector

BNP Paribas Wealth Management selected from a pool of international candidates Dr. Laura Melis, an Italian healthcare entrepreneur, as the first recipient of the ‘BNP Paribas Global Prize for Women Entrepreneurs’. Dr. Laura Melis was nominated for her exceptional achievements in combining economic performance, positive impact on society, innovation and promotion of entrepreneurship in the medical industry.

The award is the first global recognition that celebrates outstanding woman in entrepreneurship and was created together with FCEM (Femmes Chefs d’Entreprises Mondiales), the global women entrepreneur network covering 120 countries. The projects of 22 candidates from 11 countries were meticulously studied by a jury composed of leading women from Europe, Asia-Pacific and the US.

“In my entrepreneurial vision, my goal is to provide the appropriate assistance and quality of life to the greatest number of patients. We achieve this objective through new care models that combine sustainability, effectiveness and quality,” explained Dr. Laura Melis, laureate of the prize, at the award ceremony held during the 65th Annual Congress of FCEM in Rome. “I’m very honoured to receive this award which encourages me and my teams to build further on the ambition that we all share.”

Dr Laura Melis graduated in medicine and specialized in physical medicine and rehabilitation. She contributes regularly to scientific research and is often invited to speak at medical conventions on physical medicine, rehabilitation, orthopaedics, traumatology and reconstructive cosmetic surgery. Since 1997, she has been managing a healthcare group, which now includes 12 subsidiaries, 130 employees and more than 300 professional collaborators.

“At BNP Paribas Wealth Management, we support business creation by understanding, serving and celebrating entrepreneurs through various international programmes and reports, such as the Global Entrepreneur Report or the Women Entrepreneur Programme at Stanford,” added Sofia Merlo, Co-CEO of BNP Paribas Wealth Management. “We wanted to go one step further to celebrate women entrepreneurs at an international level. The ‘BNP Paribas Global Prize for Women Entrepreneurs’ was therefore created to highlight the role women entrepreneurs play for future generations, to inspire future entrepreneurship and to promote women in the entrepreneurial space.“

About Dr. Laura Melis’ accomplishments

Committed to Developing Social and Healthcare Inclusion

Amongst Dr Laura Melis’ various achievements in the health and social sector, Dr. Melis won a competition to facilitate the inclusion of disabled people in the professional world. In 2009, she signed a letter of agreement with the city of Rome for a training programme in this field and published her book “Physical and Rehabilitative Medicine: A Response to the Territory”. One year later, she developed for the City of Rome a fall prevention programme for the elderly.

Accelerating a Family Business to Bring It into the Connected Age

Dr. Melis’s commitment to healthcare is a family story. In her career, her family has played a key role but mostly her mother. From an early age, Dr. Melis worked alongside the general management of her family’s group to learn each sector of the business. This experience helped her achieve structural and technological changes and organic growth for the business that she is now leading.

Over the years, Dr. Melis has grown the business to include new sectors such as hospitality facilities for families of acute care patients. Dr. Melis is currently managing 12 subsidiaries, including two clinics, a long-term care facility, medical laboratories, a research foundation, and the latest start-up company Sanitbook.

Sanitbook is a digital solution that helps patients manage their healthcare and medical regimes thanks to an online health file, that is always organised, up-to-date and accessible from anywhere in the world. It is a major step in Italy to better leverage e-Health.

The Best Healthcare, Regardless of Patient Status

Over the past decade, Dr. Melis has driven her corporate strategy to focus on developing new solutions for healthcare needs. For instance, newly acquired facilities are completely restructured so that they meet patient care needs and pricing policies have been put in place for the economically vulnerable that cannot access high cost private care.

Over the years, the group has continued to reinvest its profits in new technologies and services to ensure sustained growth based on service quality.

Sector Leadership Thanks to Constant Innovation and Training

Dr. Melis is always seeking to improve the service quality her company is offering to patients. Teamwork is key to achieving that goal and staff is encouraged to innovate, by creating new services, streamlining processes, developing solutions across the entire healthcare value chain from a patient’s first perception of a need until the resolution of the health issue.

The group has always focused on the quality of human relationships in the workplace, even as it has grown over the years.

Staff have access to a myriad of training opportunities which can open doors to new opportunities within the company. The group also hires and trains young people just starting out in the professional environment and has agreements with several schools to provide professional training in various health domains.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €358 billion worth of assets under management (as at 30 September 2017) and was elected “Best Private Bank for Entrepreneurs” in 2016 and 2017.

Press contacts BNP Paribas Wealth Management

Claire Helleputte

PRESS CONTACTS

+33(0)1 55 77 89 63

Sarah Worsley

Press contacts – BNP Paribas Wealth Management

+33 (0)6 64 36 74 35

The 2018 Global Entrepreneur Report has revealed that 39% of Elite Entrepreneur respondents now consider ‘positive impact’ to be core to how they assess business performance, compared to 10% of respondents two years ago. This significant increase clearly demonstrates a shift in the entrepreneurs’ mindset, and this across all regions. Over the past 12 months, the concept of positive impact, which consists in ensuring that their business, investments and personal practices make the world better, has moved up the agenda for entrepreneurs. The report which polled over 2,700 multimillionaire entrepreneurs in 22 countries, handling a total wealth of USD 36 billion, highlighted that:

- 55% have declared they committed a proportion of their wealth to achieving socially responsible outcomes.

- 80% believe that entrepreneurship is the best way to generate a global or local impact in particular relating to help safeguard the environment (with 53% in China). In Europe clean energy is the most popular cause (35%) while in the US and the Middle East, job creation ranks top of the impact agenda (36% and 40%).

- Elite Entrepreneurs anticipate significant increases in their future use of investment funds (34%), start-up financing (34%), private equity (32%), equity funding (32%) and impact investing (29%).

“There is a rapid change of mindset, impacting the ways Elite Entrepreneurs invest their wealth. We recently broke the bar of €10 billion invested in responsible investments, which has more than tripled in the past 3 years. This clearly demonstrates the growing appetite from our clients for these types of strategies.” explains Sofia Merlo, Co-CEO at BNP Paribas Wealth Management. “Their investments can amplify their ambitions to create a better environment for the next generation while reflecting their values. The ‘millennipreneurs’ hold great wealth potential and will lead the way: impressively, 64% of them are already actively engaged in impact investing, particularly in terms of job creation”, underlines Vincent Lecomte, Co-CEO at BNP Paribas Wealth Management. Regional variations The Global Entrepreneur Survey has also highlighted regional variations. For Switzerland, 41% of respondents declared committing a portion of their wealth to responsible investments with the main areas being: environment investing (29%), equity funding (25%) and crowd-funding (16%). The top causes Swiss Elite Entrepreneurs aim to have an impact on are clean energy (54%), safeguarding the environment (48%), and create jobs (41%).

The 5 global profiles of Impact Entrepreneurs:

ULTRAPRENEURS – an entrepreneur with a net investable wealth in excess of USD25 million.

- 67% of Ultrapreneurs are Responsible Investors, with environmental and social business investments their most frequently used vehicles. They invest in this way to create jobs (41%), safeguard the environment (38%) and support the transition to clean energy (32%).

SERIALPRENEURS – an entrepreneur who owns or has established four or more operating companies.

- They are more focussed on using their wealth strategically to support other high-potential businesses: they allocate 15% of their portfolio to angel investments and private equity to fund new companies.

MILLENNIPRENEURS – an entrepreneur aged 35 or under

- 46% say they define their business success in terms of social impact, compared to 39% of all entrepreneurs. Despite this, a majority do not feel satisfied with their achievements in this area to date and identify social impact as a future business priority.

WOMEN ENTPRENEURS

- Women Entrepreneurs continue to outperform their male peers with a higher average net worth. They are more motivated than their male counterparts to hold ESG (Environmental, social & corporate governance) investments to ensure a positive impact, at 37% vs 33% for male.

BOOMERPRENEURS – Baby Boomer aged 55 or over.

- Boomerpreneurs take their social responsibilities seriously and are more assured than their younger peers that they have made a social impact during the 19 years on average since they first founded their business. 45% have an exposure to social and environmental investments with equity funds and environmental investments as favoured routes.

For more info on the report

- Discover the report on wealthmanagement.bnpparibas

- More findings on the “Voice of Wealth” app on the App Store or on Google Play Store

- #EliteEntrepreneurs

About BNP Paribas Wealth Management

BNP Paribas Wealth Management is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €358 billion worth of assets under management (as at 30 September 2017) and was elected “Best Private Bank for Entrepreneurs” in 2016 and 2017. BNP Paribas Wealth Management leverages all of the Group’s capabilities to help entrepreneurs build a bridge between professional and personal projects at each step of development of their company.

About Scorpio Partnership

Scorpio Partnership is the leading insight and business consultancy to the global wealth industry. The firm specialises in understanding the wealthy and the financial institutions they interact with. We have developed four transformational disciplines – SEEK, THINK, SHAPE and CREATE – each designed to enable business leaders to strategically assess, plan and drive growth. We leverage our deep insight into client needs and expectations to create practical and actionable business development strategies. Scorpio Partnership has conducted more than 500 global assignments across wealth for institutions in the banking, fund management, family offices, law, trusts, regulation, IT and technology, insurance and charity sectors. In the course of these assignments, the firm has interviewed almost 75,000 private investors and advisors. Scorpio Partnership has won multiple awards for its consultancy surveys, market insight and thought leadership across Europe, Asia, and the United States. These awards have been voted by industry peers. The firm is part of McLagan, an Aon Hewitt group company.

Press contact BNP Paribas Wealth Management

Sarah Worsley

Press contacts – BNP Paribas Wealth Management

+33 (0)6 64 36 74 35

Claire Helleputte

PRESS CONTACTS

+33(0)1 55 77 89 63

Last July, 40 business women went to the Women Entrepreneur Program hosted by BNP Paribas Wealth Management in the Stanford University (California, United-States). We met one of them, Aurélie Egret, woman entrepreneur and managing director of Orny Holding SA. During her interview she talked about her expériences and gave her feedbacks on this week-long program in Stanford.

“When BNP Paribas suggested this exciting and comprehensive program, I immediately accepted.”

During a whole week, Aurélie had the opportunity to meet business women for 12 different cournties. She also followed many conférences on leadership et business acceleration.

“The classes were held in a caring and inclusive environment. The speakers were all inspiring and the topics covered were varied, pragmatic and concrete, which means that, after just a week, we have real areas of improvement to implement when we’re back at the office.”

Read the full interview with Aurélie Egret on BNP Paribas Wealth Management website.

From July 9-14, 40 talented women entrepreneurs from 12 countries will attend a week-long program on leadership and accelerating business on the Stanford campus (California, USA).

The aim of the program is to meet the needs of businesswomen and to offer a unique mix of knowledge, skill acquisition and development. The entrepreneurs were selected for their experience and their growing companies with a broad international appeal.

In partnership with the Women Initiative Foundation, BNP Paribas will gather women entrepreneurs from Belgium, France, Germany, Hong Kong, Indonesia, Italy, Luxembourg, Malaysia, Poland, Switzerland, Taiwan and the USA, These entrepreneurs represent various sectors of activity including hospitality, child development, finance, logistics, real estate, food and fashion.

This content-rich week is built on three pillars

- Academic insight with faculty from Stanford Graduate School of Business.

- Company and incubator site visits in the Silicon Valley.

- Networking sessions among participants to explore potential business opportunities.

“The successful women entrepreneurs we have invited over the last two years have found this program to be an excellent personal and professional development opportunity. As part of an international Group that offers one-stop shop expertise for entrepreneurs around the world, we can help them accelerate their growth,” explained Sofia Merlo, Co-CEO of BNP Paribas Wealth Management. “In addition, the participants continue to play an important role in inspiring other women entrepreneurs, particularly the ones just starting out. We therefore invite our participants to share their experience as widely as possible.”

The Stanford Program highlights BNP Paribas Wealth Management’s commitment to understand, serve and celebrate women entrepreneurs. Over the course of this 4 year-long initiative, BNP Paribas Wealth Management will have provided more than 150 women with training from the Stanford Graduate School of Business along with personal and professional development.

“Through educational programs, mentoring and outreach activities, the Woman Initiative Foundation is a resource for women entrepreneurs, employers and public policy makers. We are proud that The Stanford Program contributes to the global discussion on gender diversity and to the promotion of women in the entrepreneurial space,” added Martine Liautaud, president of the Women Initiative Foundation. “Plus, it’s an incredible opportunity to discover the vibrant campus and intellectually challenging atmosphere of this world-renowned academic institution.”

Portraits of some of the 2017 participants

HONG-KONG: Joyce CHANG – Founder and Managing Director of Spring Learning

Joyce Chan is the founder and managing director of Spring Learning Centre in Hong Kong. Joyce conceived Spring as a holistic center for helping children achieve their development and learning potential during their crucial growth years. She gathers an innovative and passionate group of experts, like herself, who strive to make every experience at Spring a positive and enlightening one. Students are immersed in a variety of stimulation activities and their caregivers receive the necessary know-how to augment that ongoing process.

FRANCE: Aliza JABÈS – Founder & CEO of Nuxe

Aliza Jabès, an inspired female entrepreneur, decided early on to be the mistress of her own destiny. At the start of the 1990s, she took over a small formulation laboratory in Paris, and decided to make out of it the springboard for a beauty brand bringing together nature and luxury. Her philosophy: ultra-feminine natural skincare based on a pharmaceutical approach combining glamour and innovation. Today, with its 45 filed patents, Nuxe is a leading brand in French pharmacies and is present in 75 countries.

POLAND: Katarzyna KOLMETZ – Founder and CEO of Polipack

Katarzyna Kolmetz is the founder and CEO of the innovative packaging company Polipack based in Poland. Her company specializes in the design and manufacture of high quality packaging for industries such as cosmetics and pharmaceuticals, producing both tailor-made and stock packaging. Polipack accompanies clients across the entire process, ensuring that the finished product reflects and serves the brand values of its customers. She is convinced that the people and family members are the foundation of her company, they are the reason of its success. Katarzyna is committed to reducing her company’s environmental footprint in terms of use of resources and waste and has received prestigious quality assurance certificates from industry benchmarks.

BELGIUM: Myleen VERSTRAETE – Owner of MV Green

Myleen Verstraete comes from an entrepreneurial family and bought her first building to convert into luxury apartments over 18 years ago. She continues to buy and renovate apartments and houses, and today owns several buildings and apartments, which she rents primarily to expats in Brussels. Myleen works closely with architects and coordinates and oversees the renovations.

The last 2 years she became also a well-established impact investor from Belgium and has made a powerful statement investing in the sustainable fashion brand MC Collignon, The Conscious Collection. This ready-to-wear brand is helping to contribute to a cleaner planet by creating ultra-soft fabrics for an elegant clothing collection using recycled plastic bottles. When Myleen invests, it’s for the long-term: her involvement goes beyond a financial contribution, actively participating in the success of the companies she has chosen for investment.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimizing and managing their assets. The bank has €355 billion worth of assets under management (as of March 2017).

About the Women Initiative Foundation (WIF)

Launched in 2016, WIF gathers, organizes and leads a large network (WIFs Global Circle Network) composed of mentees and mentors, strategic partners such as BNP Paribas, company managers, experts and friends, in France as well as on an international scale (Europe and the United States). WIF encourages the promotion of women in business and in economy generally and aspires to become a laboratory of ideas as well as a strong voice in favor of the equality, respect and recognition of women in business.

Beyond its action of philanthropic sponsoring, its goal is to encourage research on these themes through studies, Pan European reports and specialized works.

At the end of 2016, WIF launched a transatlantic program intended for the French entrepreneurs wishing to develop their activities in the United States, receiving support from American mentors, and to the American entrepreneurs willing to establish their companies in Europe with the cooperation of a European mentor.

Claire Helleputte

PRESS CONTACTS

+33(0)1 55 77 89 63

Mathilde Ozanne

Women Initiative Foundation press contact Agence Raoul

+33 (0)6 09 99 13 84

Over the ten years during which BNP Paribas has been awarding the Individual Philanthropy Prize, the Group has observed and highlighted new, innovative, more collaborative forms of philanthropic activity, as philanthropists are more committed and seek to become increasingly professional in their approach.

The BNP Paribas Individual Philanthropy Prize has recognised 18 outstanding philanthropists since 2008, with one of two awards – the Grand Prize and the Jury’s Special Prize.

- Amina Slaoui (2008)

- Mo Ibrahim (2008)

- Odon Vallet (2009)

- Albina du Boisrouvray (2009)

- Claude Chagnon (2010)

- Chung To (2010)

- Peter Carey (2011)

- Ramhi Koç (2011)

- Vivianne Senna (2012)

- Michael de Giorgio (2012)

- Chuck Slaughter (2013)

- Shiv Nadar (2013)

- Charly & Lisa Kleissner (2014)

- Thomasz & Barbara Sadowski (2014)

- Molly Melching (2015)

- Fayeeza Naqvi (2015)

- Yann Borgstedt (2016)

- Ed Scott (2016)

“The tenth anniversary of the BNP Paribas Individual Philanthropy Prize provides an opportunity to underline the strong commitment of the Group’s Wealth Management arm to promote individual philanthropy with an aim to inspire a new form of activity,” declared Sofia Merlo, Co-CEO of BNP Paribas Wealth Management. “The Prize enables us to highlight and reward the remarkable work done by philanthropists all over the world.”

Tailored assistance for philanthropists

In 2008, the Bank launched a Philanthropy advisory service designed to help BNP Paribas Wealth Management clients to set up philanthropic projects. This comprehensive offering consists of tailored advice, a mechanism for managing personal donations, plus a range of ready-made solutions for those wishing to engage in philanthropic work. This service is available all over the world, with specialised teams operating in Europe, Asia and the United States.

“We advise clients and help them with the conception and implementation of a philanthropic project that is in line with their convictions and their ambitions,” explained Nathalie Sauvanet, Head of Individual Philanthropy Services at BNP Paribas Wealth Management. “Since 2008, we have assisted some 900 clients in France and abroad with their philanthropic activities.”

Keeping abreast of philanthropists’ motives and objectives: focus on the new generation

“It’s vital that we remain able to really understand the needs of philanthropists and stay abreast of the motivations and ambitions of the younger generation so that we can continue assisting the philanthropists of tomorrow and the future,” underlined Vincent Lecomte, Co-CEO of BNP Paribas Wealth Management. “Our clients are increasingly looking to have a positive impact on society. The Millennials in particular are taking an increasingly global and collaborative approach. They behave more like what you might call ‘philentrepreneurs’ – i.e. they have a more results-oriented attitude.”

Accordingly, the BNP Paribas 2017 Report on Individual Philanthropy, compiled by The Economist Intelligence Unit, closely investigates the motivations of ‘Generation Y’, focusing on their involvement in family foundations and their new-style approach to philanthropic work, making greater use of digital tools and innovative strategies. The report demonstrates the Group’s desire to better understand, serve and highlight the work of philanthropists all over the world.

The five new attitudes shaping the actions of the new generation of philanthropists

- A spirit of social entrepreneurship: The Millennials regard social entrepreneurship and profit-making companies as a generally more sustainable solution for achieving their philanthropic ambitions than non-profit entities. The emerging sectors which they are targeting for their social enterprise projects include fintechs, education technologies, renewable energies, agriculture and the agri-food business.

- A global approach: While the baby-boomers have tended to concentrate on a single region, Generation Y philanthropists take a more international approach in the causes and areas they target, essentially looking to extend the successes they achieve to many other places.

- Emphasis on the present: Millennials do not generally like to wait before getting into philanthropic activities. They tend to believe they are able to change the world today.

- A different use of social networks: Millennials use the social networks in a different manner from baby-boomers, i.e. not only to promote the causes they support but also to find beneficiaries, recruit people or keep up to date on current trends.

- A more collaborative culture: The new generation firmly believe they can be more effective if they connect with their peers through international or local networks in order to seek out opportunities for joint investments and co-financing, obtain ideas and discover philanthropic best practice.

CLICK HERE TO READ THE ENTIRE REPORT BNP Paribas Wealth Management is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €355 billion worth of assets under management (as of March 2017). The Philanthropy Advisory is one of the asset diversification services offered by BNP Paribas Wealth Management alongside Private Equity, Real Estate, AgriFrance – active in the field of rural and agricultural property – and Art Advisory.

Press Contact: BNP Paribas Wealth Management

Servane Costrel de Corainville

Press Contact – BNP Paribas Wealth Management

+ 33 6 74 81 98 27

Claire Helleputte

PRESS CONTACTS

+33(0)1 55 77 89 63

Agrifrance, a specialist division of BNP Paribas Wealth Management, today publishes its annual report on the agricultural and rural economy, this year including an analysis of the United States wine market, which has since 2013 been the world’s top market for wine consumption.

The main conclusions of the report:

- The world wine market is expected to grow, posting an increase of 3.5% by 2018*, with the United States remaining the main growth driver

- The US has the 5th largest wine-growing area and is the 4th largest market in production terms, behind Italy, France and Spain

- California produces the lion’s share (90%) of wines produced in the US

- French wines remain the undisputed leaders in the US top-end segment and rosé wine market

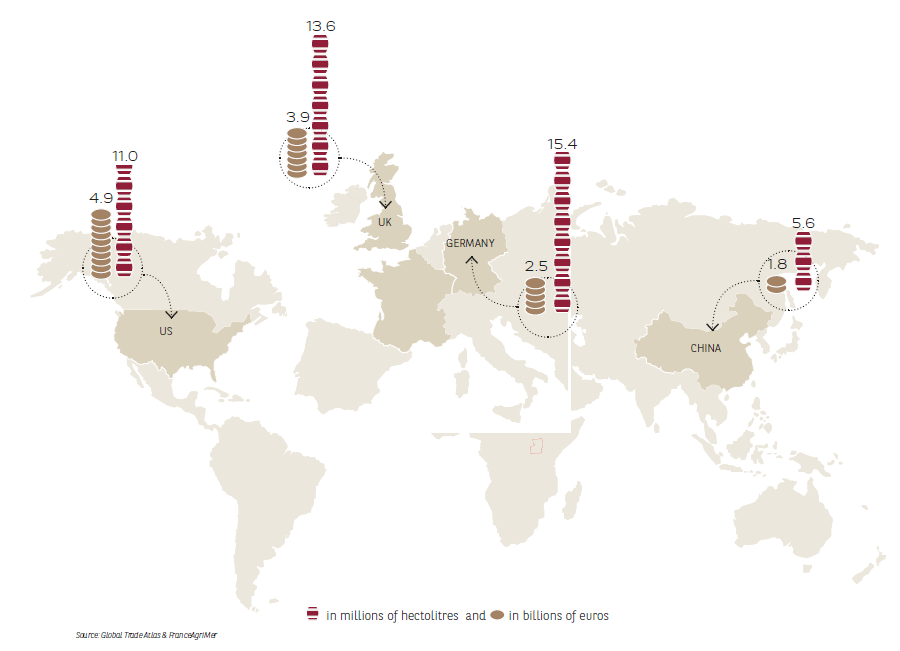

“The US is both a producer and consumer in the wine market. With 419,000 hectares, the United States boasts the 5th largest wine-producing area in the world and produces 22 million hectolitres, which makes it the world’s 4th largest market in terms of production,” underlined Benoit Léchenault, Head of Agrifrance, adding: “Prospects are very favourable in the United States for French wines, which set a benchmark in the market. Despite stiff competition, French products enjoy a number of advantages.“

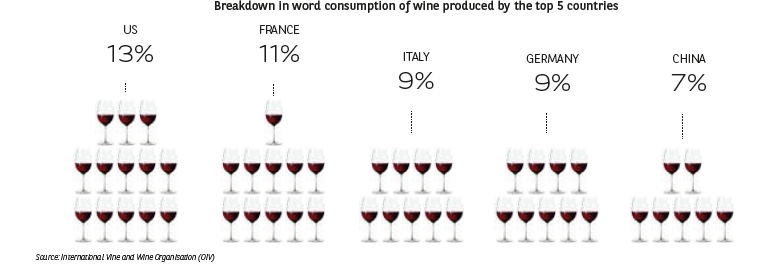

Consumption by, and imports into, the USA

Worldwide, one bottle of wine in four is consumed outside its country of origin, but – in contrast to New Zealand, Australia and Chile, countries which export 60% of their wine – the United States consumes 80% of its own production. Since 2013 the US has been the world’s leading wine-drinking country, consuming 31 million hectolitres in 2015, i.e. 13% of global consumption. Next comes France with 11%, followed by Italy and Germany, each with 9%, and China with 7%.

Top-end wines increasingly popular with US consumers; French wine remains a benchmark

While French vineyards are losing ground to new-world producers and French wine-growers continue to face many challenges, France nevertheless remains an undisputed leader in the US top-end segment (premium and ultra-premium) and in the rosé market. The United States is the top customer for France’s Provence region, buying 36% of wine exports from the region.

Italy is still the number one wine supplier to the United States, with 28% of volume and 31% of value. However, France, with only 11.6% of volume, enjoys an excellent image and remains a benchmark for top-end wines. France ranks second on market share by value, with 29%.

Breakdown of the world wine consumption market: top 5 countries

The top 4 wine importing countries

About Agrifrance

Agrifrance is the specialist rural property division of BNP Paribas Wealth Management, offering clients seeking the right investment and wealth management solutions the benefit of over 40 years of experience in the viticulture, farming, forestry and prestigious homes markets. With its network of recognised professionals, Agrifrance is also able to provide complementary services such as expertise in and management of rural properties.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management (www.wealthmanagement.bnpparibas.com) is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €344 billion worth of assets under management (as of December 2016).

Servane Costrel de Corainville

Press Contact – BNP Paribas Groupe

+ 33 6 74 81 98 27

ISWR-Vinexpo 2015 Report

The exclusive 2017 BNP Paribas Philanthropy Report written by the Economist Intelligence Unit explores how the Next Generation of Philanthropists is shaping the future of philanthropy, balancing the weight of family legacies through new tools, technologies and stratégies.

The report is based on desk research, in-depth interviews of millennial philanthropists and philanthropy experts.

The five main characteristics of the millennial philanthropist mindset:

- Belief in social entrepreneurship: millennials believe that supporting entrepreneurship and for-profit organisations (as opposed to a traditional non-profit) can be a more sustainable option to achieve their philanthropic ambitions. Their emerging sectors for social entrepreneurship are FinTechs, EdTechs, Renewable Energy and Food & Agriculture.

- A global approach: millennials are more global both in their causes and geographies than Baby Boomers: the younger generation wants to replicate successes across many places whereas the older one is focused on a single region.

- A desire for now: millennials do not want to wait before giving back as they know that they can make a change today.

- A different use of social media: millennials use digital channels differently from Baby Boomers, not only to promote their causes, but also to find grantees, donors, talents and to educate themselves.

- A collaborative culture: millennials believe they can be more effective if connected with peers through international or local networks, looking for co-investments, co-funding, new ideas and best practices.

“Over the past few years, we’ve seen our clients increasingly seek positive impact on society,” explained Sofia Merlo, Co-CEO of BNP Paribas Wealth Management. “Millennials especially are pushing the boundaries of traditional philanthropy with a stronger collaborative spirit and a greater use of Impact Investing or Social Entrepreneurship and co-funding opportunities.”

“Learning the next move of young High-Net-Worth-Individuals, their values, and their objectives, are crucial ambitions in our goal to transform the experience we offer them as our next generation of clients,” added Vincent Lecomte, Co-CEO of BNP Paribas Wealth Management. “This new experience we are co-constructing with our clients and FinTechs is a unique blend of disrupting services, communities like the NextGen Club App and our NextGen Experience educational program.”

How do millennial philanthropists deal with their family legacy?

Millennials do not feel that they have to be necessarily tied to their family legacy. They are striking a balance between the seemingly opposing forces of this legacy and of innovation. While some prefer to do it on their own, by setting up independent structures and looking for performance indicators, others stay aligned with their family and parents’ goals but inject modern practices.

« What makes a family so different from anything else is the support within. We review it [philanthropic decision] together and decide whether or not we want to go forward,” states Koon Ho Yan, 32 years old, founder of EasyKnit Foundation, Hong Kong.

In pursuit of impact, millennials adopt a specific approach to their investments. They don’t hesitate to break away from previous generations, using Impact Investing, impact evaluation or hybrid solutions. Millennials blur the lines between their investment initiatives and philanthropic activities, contrary to their elders.

« When I joined the foundation, 40% of the portfolio was in Impact Investment. But I began to question why all our investments weren’t Impact Investments,” comments Stéphanie Cordes, 27 years old, Vice-Chair, Cordes Foundation, USA.

Being a result-driven cohort, young philanthropists use digital technologies to capture and monitor key performance indicators that measure impact. Some examples of these technologies are highlighted in the report, including the European Foundation Center Data Map providing key data on how to run a foundation in 80 different countries, or the IRIS Metrics, designed to measure the social, environmental and financial performance of an investment.

« We’ve changed our organizational structure to ensure a more professional management of the foundation, and we measure our performance. We attach great importance to providing clear and transparent information about our strategic goals and performance to our most important stakeholders and the public at large,” asserts Lavinia Jacobs, 36 years old, Chair, Board of Trustees, Jacobs Foundation, Suisse.

The 2017 BNP Paribas Philanthropy Report reflects a willingness to better understand, serve and celebrate individual philanthropists around the world. BNP Paribas Wealth Management has advised more than 800 clients in their philanthropic journey since 2008 thanks to multi-awarded teams based in Europe, Asia and the US.

READ THE FULL REPORT BY CLICKING HERE.

About BNP Paribas Wealth Management

BNP Paribas Wealth Management (www.wealthmanagement.bnpparibas.com) is a leading global private bank and #1 Private Bank in the Eurozone. Present in three hubs in Europe, Asia and the US, over 6,600 professionals provide a private investor clientele with solutions for optimising and managing their assets. The bank has €344 billion worth of assets under management (as of December 2016).

Servane Costrel de Corainville

Press Contact – BNP Paribas Groupe

+ 33 6 74 81 98 27

« What makes a family so different from anything else is the support within. We review it [philanthropic decision] together and decide whether or not we want to go forward,” states Koon Ho Yan, 32 years old, founder of EasyKnit Foundation, Hong Kong.

« What makes a family so different from anything else is the support within. We review it [philanthropic decision] together and decide whether or not we want to go forward,” states Koon Ho Yan, 32 years old, founder of EasyKnit Foundation, Hong Kong. « When I joined the foundation, 40% of the portfolio was in Impact Investment. But I began to question why all our investments weren’t Impact Investments,” comments Stéphanie Cordes, 27 years old, Vice-Chair, Cordes Foundation, USA.

« When I joined the foundation, 40% of the portfolio was in Impact Investment. But I began to question why all our investments weren’t Impact Investments,” comments Stéphanie Cordes, 27 years old, Vice-Chair, Cordes Foundation, USA. « We’ve changed our organizational structure to ensure a more professional management of the foundation, and we measure our performance. We attach great importance to providing clear and transparent information about our strategic goals and performance to our most important stakeholders and the public at large,” asserts Lavinia Jacobs, 36 years old, Chair, Board of Trustees, Jacobs Foundation, Suisse.

« We’ve changed our organizational structure to ensure a more professional management of the foundation, and we measure our performance. We attach great importance to providing clear and transparent information about our strategic goals and performance to our most important stakeholders and the public at large,” asserts Lavinia Jacobs, 36 years old, Chair, Board of Trustees, Jacobs Foundation, Suisse.