BNP Paribas Investment Partners announces its strategic growth plan 2020 and rebrands as BNP Paribas Asset Management.

To accelerate the growth of its activities, BNP Paribas Investment Partners will:

- develop as a leading provider of quality investment solutions for individual, corporate an institutional investors;

- target annual growth in assets under management of 5%;

- rebrand as BNP Paribas Asset Management (BNPP AM), as of 1 June, in order to support its strategy and a simpler organisation.

BNP Paribas Asset Management is enhancing its distinctive investment platform with the aim to delivering superior investment performance for its clients, while recognizing the changing industry dynamics, such as the increasing polarisation between lower cost passive products and actively managed higher alpha funds. The aim is to deliver sustainable long term performance with a robust risk management and ESG (Environmental, Social and Governance) framework. To do so, BNPP AM will continuously reinforce its strong proprietary research and build on existing quantitative and qualitative capabilities in both active and passive management, along with its well-established and highly-regarded equity and fixed income platforms. The company will leverage its recognised expertise in smart beta strategies, multi-asset solutions and private debt capabilities.

With a focus on providing high quality, innovative solutions including advisory services and risk management to institutional clients, the firm is also targeting individual investors with outcome-based retirement savings products, as well as providing innovative offerings such as digital platforms to distributors. Other digital initiatives will include partnering with fintechs in areas such as robo-advice, smart coding and artificial intelligence.

The organisational structure (i), governance, operating model and product range are being substantially simplified through an ambitious transformation program. Milestones so far include the creation of the Private Debt and Real Assets Team under the leadership of David Bouchoucha, incorporating a broad range of investment solutions in private debt instruments financing companies or assets such as infrastructure or real estate. BNPP AM has also launched a project to combine the current THEAM, Multi Asset Solutions and CamGestion teams, to be led by Denis Panel, current CEO of THEAM. With significant assets under management, this new group will bring together the best of quantitative and fundamental investment management approaches, to extend market share in a fast-growing segment of the industry.

BNPP AM has a strong presence throughout Europe, a unique footprint in emerging markets and growing operations in the United States. The firm continues to leverage its strength in Belgium, France, Italy and Luxembourg, as well as its presence in emerging markets, while accelerating its development in three key strategic countries: Germany, China and the US.

BNPP AM benefits from a large client base across the globe and strong relationships with the BNP Paribas Group’s retail network as well as with leading retail distributors, and will continue to develop this area of its business. In the institutional market, the firm offers a targeted and bespoke approach to meeting the specific needs of different client segments. Continued growth of its existing strong offering to corporates, central banks and sovereign wealth funds will be complemented by further expansion of dedicated solutions to insurers and pension funds globally.

“Our aim is to build on our core strengths to become a leading provider of quality investment solutions for individual, corporate and institutional investors. We are investing in a scalable platform on which to base our future growth globally and achieve sustainable long-term success. By streamlining our operating model and product range, we will be very well placed to deliver high-quality products and solutions at the right price to our clients. We believe that this will enable us to meet our growth targets and will be the key to our success.”

Frédéric Janbon, CEO of BNP Paribas Asset Management

About BNP Paribas Asset Management

BNP Paribas Asset Management is the investment management arm of BNP Paribas, one of the world’s major financial institutions. Managing and advising EUR 580 billion in assets as at 31 March 2017, BNP Paribas Asset Management offers a comprehensive range of active, passive and quantitative investment solutions covering a broad spectrum of asset classes and regions. With close to 700 investment professionals and 600 client servicing specialists, BNP Paribas Asset Management serves individual, corporate and institutional investors in 75 countries around the world. Since 2002, BNP Paribas Asset Management has been a major player in sustainable and responsible investing.

Press Contacts

Quentin Smith

BNP Paribas Asset Management

+44 (0) 20 7063 7106

Sandrine Romano

PRESS CONTACT

+33 (0)6 71 18 23 05

(i) The company structure now consists of an integrated business covering most of its operations in Europe, Middle East, Americas, Asia-Pacific and its investment management expertise and an affiliate network, including local joint ventures, autonomously managed subsidiaries and specialised management expertise such as BNP Paribas Capital Partners, BNP Paribas Epargne Retraite & Entreprises or FundQuest Advisor.

BNP Paribas takes Top Spot among European banks for Corporate Banking, Cash Management and Trade Finance in Greenwich Survey

BNP Paribas today announces it has strengthened its existing market-leading position in European corporate banking and cash management, according to results published today by Greenwich Associates.

BNP Paribas ranked first place in the following categories:

-

- Corporate Banking

- Cash Management (Europe, France and Belgium/Luxembourg)

- Trade Finance segments in the latest European Large Corporate Banking

- European Large Corporate Cash Management and European Large Corporate Trade Finance

BNP Paribas has been ranked as follows:

In the Corporate Banking field

- N°1 for ‘European Top-Tier Large Corporate Banking Market Penetration’, based on the relationships the Bank has established with 61% of the leading European companies

- N°1 for Eurozone Top-Tier Large Corporate Banking Market Penetration, based on the relationships the Bank has established with 69% of the leading Eurozone companies.

- N°1 for Belgium/Luxembourg Total Large Corporate Banking Market Penetration, based on the relationships the Bank has established with 92% of the leading companies in those markets. N°1 for France Total Large Corporate Banking Market Penetration, based on the relationships the Bank has established with 96% of the leading French companies.

In the Cash Management field

- N°1 for European Top-Tier Large Corporate Cash Management market penetration, based on the relationships the Bank has established with 40% of the leading European companies.

- N°1 for Eurozone Top-Tier Large Corporate Cash Management Market Penetration, based on the relationships the Bank has established with 50% of the leading Eurozone companies.

- N°1 for France Total Large Corporate Cash Management Market Penetration, based on the relationships the Bank has established with 91% of the leading French companies.

- N°1 for Belgium/Luxembourg Total Large Corporate Cash Management Market Penetration, based on the relationships the Bank has established with 86% of the leading companies in those markets.

In the Trade Finance field

- N°1 for European Large Corporate Trade Finance, based on the Bank’s 36% market share in the Large Corporate Trade Finance segment in Europe.

- N°1 for France Large Corporate Trade Finance, based on the Bank’s 88% market share in the Large Corporate Trade Finance segment in France.

In addition, as a result of the Greenwich Quality Leader survey in the Large Corporate Cash Management field, BNP Paribas has been ranked in equal first place alongside Société Générale in France and in equal top spot with KBC in Belgium/Luxembourg.

In order to establish its rankings, Greenwich Associates interviewed the Finance Directors of the leading companies in the respective regions. Some 597 interviews were conducted for the Top Tier European Corporate Banking segment, 638 interviews for the Top Tier European Large Corporate Cash Management segment and 496 interviews for the European Large Corporate Trade Finance segment rankings.

About BNP Paribas

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 74 countries, with more than 190,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services (whose retail-banking networks and financial services are covered by Retail Banking & Services) and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the leader in consumer lending. BNP Paribas is rolling out its integrated retail-banking model in Mediterranean countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Institutional Banking and International Financial Services activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

Malka Nusynowicz

Press Contact

(+33) 1 42 98 36 24

Valérie Sueur

Press Contact

01 42 98 67 65

Washington, D.C., March 9, 2017–The World Bank (International Bank for Reconstruction and Development, IBRD) has issued bonds that for the first time directly link returns to the performance of companies advancing global development priorities set out in the Sustainable Development Goals, including gender equality, health and sustainable infrastructure.

The equity-index linked bonds raised a total of EUR163 million from institutional investors in France and Italy. The World Bank will use the proceeds to support the financing of projects that advance its goals of eliminating extreme poverty and boosting shared prosperity, and that are aligned with the Sustainable Development Goals or SDGs.

The return on investment in the bonds is directly linked to the stock performance of companies included in the Solactive Sustainable Development Goals World Index. The index includes 50 companies that, based on methodology developed by Vigeo Eiris’ Equitics, dedicate at least one fifth of their activities to sustainable products, or are recognized leaders in their industries on socially and environmentally sustainable issues. Solactive applies volatility and diversification filters to reach the final index composition. Vigeo Eiris is a global provider of environmental, social and governance research to investors and public and private corporates.

The bonds were arranged by BNP Paribas as part of the “SDGs Everyone” initiative. Under the initiative, the World Bank will issue bonds that raise funding to support the financing of projects that support the SDGs, and investors benefit from the performance of companies included in the equity index. The initiative is an innovative solution and new financial model that supports the SDGs, as called for by the UN Secretary-General’s Financial Innovation Platform (FIP) launched in October 2016.

Arunma Oteh, World Bank Vice President and Treasurer, said: “The global community has made an ambitious commitment to achieve the Sustainable Development Goals, and this requires a new way of looking at development finance. This bond is an innovation that demonstrates the powerful role of capital markets in connecting savings with development priorities, while offering investors an attractive risk-reward profile. Looking ahead, we anticipate coming to market with similar issuances that would attract a range of investors across the globe.”

Amina J. Mohammed, UN Deputy Secretary-General, said: “The 2030 Agenda for Sustainable Development is a transformative agenda which aims to make our world more inclusive, peaceful and prosperous. There is a momentous opportunity to change incentive structures in financial markets, shape consumer preferences as well as shareholder interest so that they reflect sustainability. Collaboration between the public and private sector will help to leverage innovative financial solutions that can deliver on the SDGs.”

Investors in the bond include AGPM VIE, AREAS VIE, BNP Paribas CARDIF France, BNP Paribas CARDIF Italy, Fideuram Asset Management Ireland, Generali France, MGEN, Prevoir VIE, Sella Gestioni SGR and Suravenir.

Olivier Héreil, Chief Operating Officer and Head of Asset Management, BNP Paribas Cardif, said: “We are proud to be part of the SDGs Everyone initiative which will support the United Nations’ Sustainable Development Goals. Since 2014, BNP Paribas Cardif in France has invested more than 4 billion euros in SRI. Today we are delighted to announce that our Italian subsidiary joins our French entity in investing in this new sustainable bond. These innovative products combine financial performance with environmental and social impacts, and as a responsible investor, we are pleased to have played an active role in their development.”

Pietro Calati, Head of Investments, Fideuram Asset Management Ireland, said: “We are pleased to have been part of this initiative. Fideuram’s participation in the transaction reflects the dual mandate of our Ethical fund: to pursue financial opportunities and, at the same time, to have a positive impact on the community.”

Nicola Trivelli, Chief Investment Officer, Sella Gestioni SGR, said: “We are enthusiastic to invest in this initiative in support of the SDGs and look forward to more issues like this.”

Bernard Le Bras, President and Chief Executive Officer, Suravenir, said: “We are very proud to participate in this innovative initiative which supports the UN’s Sustainable Development Goals. Innovation and responsible investments are at the heart of the strategies of Suravenir and Credit Mutuel Arkea. We see this as an opportunity to promote innovative investment products that combine performance with sustainable investments, together with the great satisfaction that comes with contributing to the development of these new solutions.”

Olivier Osty, Executive Head of Global Markets, BNP Paribas, said: “We are delighted to collaborate with the World Bank on this innovative program of structured issuance to satisfy increasing investor focus on the SDGs. Innovation and sustainability are key foundations of our strategy at BNP Paribas and we are pleased to bring our expertise and commitment to the UN’s financing platform for SDGs. We are confident that we can replicate the success of the World Bank’s Green Growth Bonds with this new program.”

Learn more about World Bank Sustainable Development Bonds here.

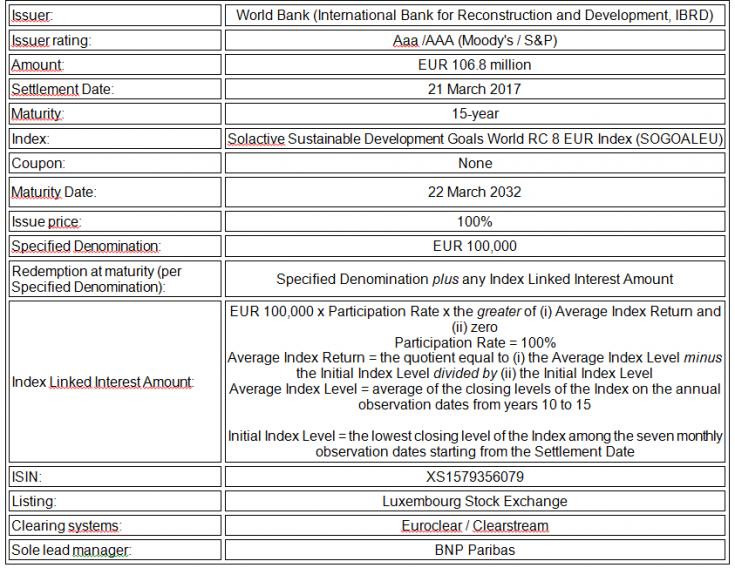

Transaction Summary for the 15-year Bond:

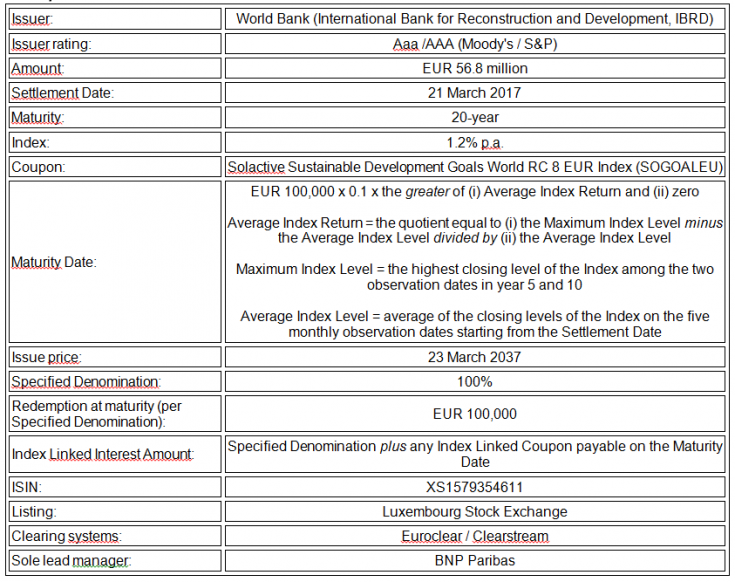

Transaction Summary for the 20-year Bond:

About BNP Paribas

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 75 countries, with more than 189,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services (whose retail-banking networks and financial services are covered by Retail Banking & Services) and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporate and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the leader in consumer lending. BNP Paribas is rolling out its integrated retail-banking model in Mediterranean countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Institutional Banking and International Financial Services activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

About the World Bank

The World Bank (International Bank for Reconstruction and Development, IBRD), rated Aaa/AAA (Moody’s/S&P), is an international organization created in 1944. It operates as a global development cooperative owned by 189 nations. It provides its members with financing, expertise and coordination services so they can achieve equitable and sustainable economic growth in their national economies and find effective solutions to pressing regional and global economic and environmental problems. The World Bank Group has two main goals: to end extreme poverty and promote shared prosperity. The World Bank (IBRD) seeks to achieve them primarily by providing loans, risk management products, and expertise on development-related disciplines to its borrowing member government clients in middle-income countries and other creditworthy countries, and by coordinating responses to regional and global challenges. The World Bank has been issuing bonds in the international capital markets for over 60 years to fund its sustainable development activities and achieve a positive impact. Information on bonds for investors is available on the World Bank Treasury website.

About the United Nations and the Sustainable Development Goals (SDGs)

World leaders agreed to implement a new plan for the future of people and the planet that has the potential to make our world more inclusive, peaceful and prosperous. The plan reflects three agreements adopted by the United Nations Member States in 2015: the Addis Ababa Action Agenda on Financing for Development, the 2030 Agenda for Sustainable Development, and the Paris Agreement on climate change. The financing required to bring about the global transformation needed to realize the aspiration captured in the 17 Sustainable Development Goals (SDGs) are estimated to be in the order of trillions of dollars annually. The United Nations is evolving to build the capacity that will deliver sustained partnerships that bring together businesses, science, civil society, and government that deliver on the Sustainable Development Goals. In October 2016, the UN Secretary-General announced the launch of a financial innovation platform (FIP) for scaling the financing of the Sustainable Development Goals (SDGs). The goal of the platform is to drive investment for catalytic SDG interventions and build momentum from governments, as well as the business and investment community for achieving the 2030 development agenda.

Contacts :

Andrew Achimu

PRESS CONTACTS

+44 20 75 95 66 47

Alexandra Klopfer

World Bank (BIRD) (Washington, D.C.)

+1 202 477 2880

Interested in a career in finance with one of the leading European banks in Switzerland?

Join a solid international group and the bank for a changing world.

BNP Paribas, present in Switzerland since 1872, is investing in the future, starting with you!

We offer a variety of exciting internship opportunities and graduate programs which will help you get the experience, the skill set and the savoir-faire to pursue a successful career in finance.

Join us at our Brown Bag Lunch in Zurich on March 30th.

Contact person :

Patrizia Forster

+41 (0) 58 212 67 11

Parvest Multi-Asset Income Emerging is a sub-fund of Parvest UCITS V SICAV, an open-ended investment company incorporated under Luxembourg law. The fund has been launched in response to demand from clients who are looking for alternative sources of income and wish to increase their emerging market exposure in line with emerging markets’ growing share of global economic output.

Parvest Multi-Asset Income Emerging is managed using the team’s top-down, macro-based fundamental active asset allocation process, combined with bottom-up active security selection at the asset class level, based on extensive knowledge and strong presence in emerging markets. It aims to target stable and regular income, in line with the other income products managed by the Multi Asset Solutions team, by dynamically allocating across emerging market asset classes and regions. Exposure will be to the main emerging market asset classes of equities, local sovereign debt, external sovereign debt, corporate debt, currencies and commodities. Weightings to equities and fixed income can vary significantly, with both ranging between 0% and 80% of the overall portfolio.

Parvest Multi-Asset Income Emerging is managed by BNP Paribas Investment Partners’ Multi- Asset Solutions team and builds on the team’s successful track record in managing multi-asset, income-generating funds, together with BNP Paribas Investment Partners’ long-standing emerging markets expertise and extensive local presence.

The Multi-Asset Solutions team has been managing income portfolios for over 10 years and consists of more than 50 investment professionals focused entirely on asset allocation, who manage more than EUR70 billion (as at 30 June 2016). With an extensive emerging markets footprint that began in 1992, BNP Paribas Investment Partners has built a presence in 16 locations, with more than 300 investment professionals managing assets of EUR64.7billion, as at 30 June 2016.

Colin Graham, CIO of Multi Asset Solutions at BNP Paribas Investment Partners, comments:

“In the current environment of sustained low interest rates and negative government bond yields, income is an increasingly scarce commodity and emerging markets can offer attractive higher-yielding investment opportunities. Market dispersion has risen of late, meaning that not all emerging markets are equal. The emerging markets universe consists of multiple asset classes, each with different risk and return profiles and different behaviours, depending on the economic cycle. By combining our established multi-asset income capabilities with the first-hand knowledge and understanding of emerging markets that our strong local presence gives us, we are able to identify what we consider to be the most attractive income opportunities from across these asset classes in order to meet the needs of our clients.”

Key fund information |

|

| Fund name | Parvest Multi-Asset Income Emerging |

| Launch date | 25/4/16 |

| Legal structure | Sub-fund of Parvest UCITS V SICAV registered under Luxembourg law |

| Share classes | Institutional, Classic |

| Delegated manager | BNP Paribas Investment Partners UK |

| Management company | BNP Paribas Investment Partners Luxembourg |

| Base currency | US dollar |

| Domicile | Luxembourg |

| Risk rating – on a scale of 1 (lower risk) to 7 (higher risk) | 5 (The higher the risk, the longer the recommended investment horizon.) |

| Max management fee | Institutional: 0.60% Classic: 1.25% |

| Max subscription fee | Institutional: none, Classic: 3% |

| Redemption fee | None |

| ISIN codes | Classic-Capitalisation (LU1270633115) Classic-Distribution (LU1270633388) Classic MD (LU1270633545) Classic HKD MD (LU1270634519) Classic SGD MD (LU1270635672) Institutional (LU1270636217) |

| Custodian | BNP Paribas Securities Services Luxembourg |

| Pricing frequency | Daily |

The value of investments and the income from them may fall as well as rise and it is possible that investors will not recover their initial investment.

Investment in emerging markets, or in specialised or restricted sectors, is likely to be subject to higher than average volatility due to a high degree of concentration, greater uncertainty because less information is available, lower levels of liquidity or greater sensitivity to changes in market conditions, or social, political and economic conditions.

Some emerging markets offer less security than the majority of international developed markets. For this reason, portfolio transactions on behalf of funds invested in emerging markets may carry greater risk.

Past performance or achievement is not indicative of current or future performance.

Sarah Marteleur

BNP Paribas Investment Partners

+32 (0)2 274 84 28

About BNP Paribas Investment Partners

BNP Paribas Investment Partners is the BNP Paribas Group’s asset management specialist. BNP Paribas Investment Partners offers the full range of asset management services to both institutional and private investors around the world. BNP Paribas Investment Partners has more than 3,000 employees in 35 countries, including more than 600 investment professionals, and manages assets totalling EUR 532 billion (source: BNP Paribas Investment Partners, as at 30 June 2016, assets under management and advisory). For more information, please see www.bnpparibas-ip.com.

Discover the strategy of BNP Paribas (Suisse) SA

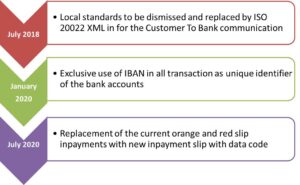

SEPA and SWITZERLAND : another major step towards a harmonised payment landscape Switzerland has been less impacted by the SEPA migration than the Euro countries. The main reason is that all the schemes in domestic currency are not in scope of SEPA, which concerns only transactions in Euro. But the Swiss Payment Council has imposed the global usage of XML ISO 20022 by 2018. BNP Paribas, in continuity with its recognised SEPA leadership and expertise of the Swiss Cash Management market since 1872, clarifies the upcoming changes and what corporates need to do. The payments and collections landscape has drastically changed in the last 5 years. New regulations (SEPA, PSD) and technical innovations such as virtual account technology and the introduction of a single suite of message standards (ISO 20022 XML) have translated into more efficient process, cost reductions and a re-thinking of Cash Management for corporates doing business in Europe. Not without a cost: European utilities using direct debits as main collection method had to face quite a few headaches only to migrate the existing client database. In this respect, Switzerland has been a “happy island” within the SEPA area, with minor impacts on their internal processes and back-end systems. Nevertheless, in order to harmonise the payment landscape and bring further efficiencies to Swiss based businesses within the SEPA area, the Swiss National Bank has decided to plan changes in the domestic payment and collections market. What is in for Swiss businesses? Similarly to what is happening in other SEPA domestic markets (e.g. Italy is looking at how to further reduce the niche payment transactions like MAV, Ri.BA etc..), the Swiss national bank is aiming at reducing the number of payment and direct procedures and in particular has confirmed the adoption of ISO 20022 as the single suite of message to be adopted. Today Switzerland is supporting one domestic credit transfer file format -“DTA” and for direct debits the “LSV” format, though a clear timeline has been announced by the Swiss National Bank as when the both will be outdated and replaced by the ISO 20022 standard XML:

2016 BNP Paribas Global Entrepreneur Report Based on one of the largest international surveys ever carried out, polling almost 2,600 multimillionaire entrepreneurs in 18 countries Get more details on the following press release : CPREPORT-version UK

Professor of Law at Geneva Law School -of which he was appointed Dean from 2007 to 2012 – and Doctor in Law, Christian Bovet has more than one string to his bow. After his admission to the Bar, he worked as an associate lawyer in a Geneva law office specialized in business law. In 1988 he graduated from Columbia University School of Law in New York which enabled him to work as a Foreign Associate in the New York division of Debevoise & Plimpton international law firm. Curious and eclectic, Christian Bovet is keen on meeting new people and is involved in many activities aside from work. Among other things he chairs the Board of the Walther Hug Foundation that rewards the best doctorates defended in Switzerland every year. On a regular basis it also rewards professors in recognition of their outstanding academic work. From 2005 to 2011, he was vice-president to the Swiss telecommunication market regulator, the Federal Committee for Communication. From 2009 to 2011, Christian is in charge of the task force dedicated to revising the law surrounding the cartels. Furthermore, he is an active member of the Concurrences magazine editorial board. He used to be part of the Swiss banks’ Ombudsman Foundation Counsel, of the lawyers examination committees and of the Foundation Counsel for medical research. The list of his numerous commitments goes on and demonstrates his dedication for important causes.

Press Contacts

Isabelle Wolff

HEAD OF BRAND & COMMUNICATION

+41 58 212 81 10

Laurence Anthony

MEDIA RELATIONS

+41 58 212 97 62

BNP Paribas (Suisse) SA is launching swissinsights.bnpparibas.com, the strategic analysis blog from the Group in Switzerland. This public platform will strengthen the bank’s online presence and is supported by its Twitter account @BNPParibas_CH. Starting in June 2013, experts from the different divisions of BNP Paribas (Suisse) SA will use this blog to share their comments on the economic environment. Their remarks will be published each week according to current events. The aim of the blog is to facilitate the understanding of macroeconomic analyses from the bank’s analysts. Each post will react to or underline an important economic situation, explaining what is at stake and the problems involved from the angle of the respective comment and viewpoint. Swiss Insights reflects the Group’s desire to be at the forefront of innovation and the use of social media. Every posts published on Swiss Insights will be relayed by social media to enable them to be shared with the greatest possible number of people. The platform does not publish investment recommendations or advice on the products and services of BNP Paribas in Switzerland. Other digital tools The Swiss Insights blog from BNP Paribas in Switzerland is supported by other instruments used by the bank to ensure an online presence:

- A Twitter account: @BNPParibas_CH, launched last March.

- A LinkedIn page: BNP Paribas Switzerland.

- The Internet site of BNP Paribas in Switzerland: www.bnpparibas.ch.

- The Internet site of BNP Paribas Wealth Management in Switzerland: www.wealthmanagement.bnpparibas.ch.