These last few weeks, the bank has put in place a series of solidarity actions in favour of people in precarious situations, of youth suffering from digital divide, of hospitals and medical staff, as well as of the local small businesses.

Since the start of the COVID-19 pandemic, the BNP Paribas Group as a whole has mobilized to contribute in helping the people and institutions the most affected and exposed to this sanitary crisis. This global emergency plan represents a total amount of more than 50 million euros, structured locally – in many of the countries where the Group is present – around concrete and local actions focused on three main targets: hospitals, fragile populations and youth.

We also endeavor to support our most isolated beneficiaries through regular phone calls, and to help our most precarious or needy with food or rent.”

Benjamin Lachat

Donations made by employees

Donations made by employees, and largely completed by a corporate donation from the bank, enabled to support the Red Cross entities in Geneva, Zurich and Lugano up to more than 60’000 CHF. Since the beginning of the sanitary crisis, the Red Cross reorganized its activities to help people who are the most isolated and “at risk” during the epidemic, as well as those in precarious situations

« Loyal to its local mission of helping people in need, the Geneva Red Cross has reorganized its activities since the beginning of the pandemic in Switzerland. We have started a service destined to support people who are at risk and confined at home by offering various services like delivering groceries or walking their pets. We also endeavor to support our most isolated beneficiaries through regular phone calls, and to help our most precarious or needy with food or rent. Such actions are possible thanks to our hundreds of volunteers and the support of our generous patrons, whom we thank deeply».

Benjamin Lachat, Fundraising officer, Geneva Red Cross

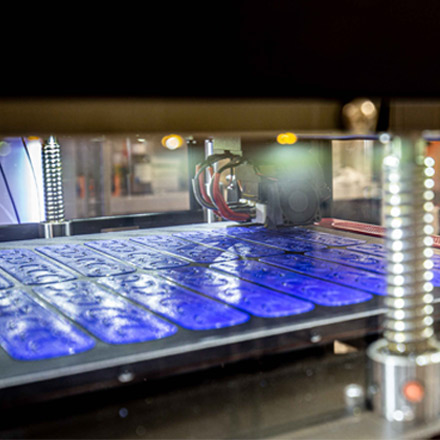

Financing two 3D printers

A corporate donation to the Hôpitaux Universitaires de Genève (HUG) to finance two high-tech professional 3D printers, which will allow the production at high speed many and with great autonomy of different pieces meant to complement medical equipment, especially for medical staff protection and patients.

« These new printers help to support all current and future productions of the 3D print center at Hôpitaux Universitaires de Genève. For the time being, fabricating the clip that upholds the elastic of masks significantly improves the comfort of the HUG teams and their patients. These two printers double the production capacity of these clips. In a second phase, they will contribute to innovations and research within the HUG by, for example, creating prototypes or anatomical models. »

Stéphane Hertig, Print Center Manager, Surgery department, HUG

Reduce the digital division

A corporate donation to the YOJOA –Youth Job Accelerator association, working in favour of the professional integration of young refugees in Geneva, to buy twenty laptops for the programme’s young beneficiaries who cannot follow their online courses.

« Quarantine measures have highlighted social inequalities regarding education in Geneva.

Young migrants are a part of the population which was isolated by this crisis because they do not have decent digital tools to access the online classes provided by public education.

The support of BNP Paribas has been essential to equip the Foyer de l’Etoile with laptops so that young migrants may take their courses and continue on their way to apprenticeship and employment»

Emmanuelle Werner, Director, YOJOA

Skill-based support

Our employees support SMEs in Geneva

Skills-based support from volunteer employees to help the small businesses in Geneva that are partners of réalise (an institution otherwise supported by the BNP Paribas Swiss Foundation for its “Opportunity” programme, aiming to promote equal opportunities for tomorrow’s jobs).

“Thanks to our values to engage and accompany change, our two companies have united their strengths in a solidarity plan dedicated to Geneva’s’ SMBs by offering réalise the expertise of BNP Paribas in Switzerland’s employees! After COVID-19, a world that changes through a transition to a sustainable economy!“

Cécile Marguerat, Public relations and Communication manager, Réalise

A hackathon to adapt and face post Covid-19 challenges

Skills-based support to the Canton of Geneva new “Crisis and resilience innovation Fund”, which seeks to collectively develop disruptive projects in response to the current and future economic challenges. The bank’s employees will thus have the opportunity to participate in the Geneva Resilience Hack, from June 12 to 14th.

For the past few weeks, our teams have been dedicated to support more than ever our Clients. We thank them all for their dedication and professionalism whether they were working from home or from our offices in Zurich, Lugano or Geneva.

We have met Slaven Maligec, Head of CHF Debt Syndicate and located in Zürich, and talked about the health crisis, new ways of serving our Clients and about the necessity to adapt during these particular times.

Slaven, could you tell us more about what you do and where have you been working from during the lockdown?

I am Head of CHF Debt Syndicate. I am not working from home and I remain on site as my work installation requires a lot of hardware and computers!

However, we have adapted our organisation: split team in the office, split team at home during home schooling and recent holidays.

What was your state of mind during these past few weeks?

My philosophy regarding this lockdown can be summarized as follows : “Take it like a man”…may be rather: It is what it is, make the best of it as it is just a waste of time to be moaning all day long !

My state of mind is positive, as I am myself. It is definitively a new experience, rather scared given relatives and friends been part of the “high risk group” but not scared myself.

I try to take the positive side. There is definitively more family time as we do #stayathome and more things to do together at home.

My state of mind is positive, as I am myself. It is definitively a new experience.”

Slaven Maligec

We are glad that you and your family are doing well. How your clients have been coping with the situation? What are their main preoccupations?

Regarding the post Covid-19, our clients are a bit worried about the near future to some extend as uncertainty leads to discomfort, but they are adapting to the new environment rapidly as there is no choice, working from home related or also to the new pricing landscape.

I think that people tend to forget quickly as soon as we are facing a more normalised situation but I think given the impact we will keep that in memory and hopefully be better prepared when the next crisis will occur. There is only one life, birth and death are determinate, the time in between should be fun, at least part of it.

And for the next changes? We shall be masked soon and stay masked for quite some time…

CoVid-19: Message from Monique Vialatou to clients and employees of BNP Paribas in Switzerland

24 March 2020

Dear all,

The unprecedented sanitary crisis we are currently experiencing has led many countries, including Switzerland, to impose restrictive measures that have a strong impact on everyday life. It is a shock for the worldwide economy and populations.

Our responsibility is to contribute to the economy’s smooth operation, thanks to the implementation of exceptional measures throughout our different buildings in Switzerland.

Ensuring the continuity of our economic activities and preserving the health and security of our employees

The health of our employees is our number one priority.

Thanks to the implementation of teleworking for the vast majority of our employees, we safely ensure the continuity of BNP Paribas in Switzerland’s economic activities.

Our teams are mobilised and committed to answer our client’s questions and to support them during this difficult period. They pursue their mission tirelessly while showing extraordinary discipline and dedication. Through this message, I want to thank them for that.

Accompanying our client through this sanitary crisis

I am aware that this unprecedented situation is a challenge for our clients, whether they are companies, institutions or private individuals. Appropriate measures are taken to accompany them daily and support them through this hitherto unseen crisis.

We all have a role to play. Each of us has a specific responsibility, both professional and personal. I know we will honour our commitment to serve our clients and more than ever to keep playing our part in service to the economy.

Take care of you and your family, more than ever.

Monique Vialatou

CEO of BNP Paribas in Switzerland

Isabelle Wolff is appointed Head of Company Engagement for BNP Paribas (Suisse) SA.

She will continue to fulfil her role as Head of Brand & Communication and, in line with the Group’s policy, is now in charge of CSR and the Foundation. She will also coordinate the implementation of the Bank’s diversity policy in Switzerland.

Isabelle Wolff joined the BNP Paribas Group in 1999, commencing with BNP Paribas Leasing Solutions. Starting from 2002, she made a major contribution to safeguarding and promoting the Bank’s image both in terms of internal communication and through her media expertise within the Group’s Communication team.

In this capacity, she helped foster and enhance the Bank’s key projects in terms of company engagement, particularly the Projet Banlieues, alongside associations such as Adie, Afev and others. Since 2014, she has worked on implementing and developing the Bank’s communication strategy.

“BNP Paribas makes societal engagement an integral part of its development strategy. I take this role very seriously because it is our duty to meet social expectations to build a sustainable and efficient bank.

I take the measure of my role and will strive to intensify the local implementation of the Group’s commitment policy in the four areas of energy transition and environment, social inclusion of young people, entrepreneurs and territories”

Starting from August 2019, Vontobel’s digital market place for structured products, deritrade, will expand its product offering to investors with the introduction of Autocallable Barrier Reverse Convertible payoff structures from BNP Paribas as the eighth

issuer on the platform.

“We are very happy to join as an issuer on one of Switzerland’s leading structured products platforms for Private Banking clients. It enables us to gain immediate access to over 70 Swiss banks and 550 External Asset Managers with an addressable AuM potential of over CHF 2’000 billion – in a purely digital fashion, since deritrade offers a fully automated service for the end client”, says Renaud Meary, Global Head of Private Banking and Distribution at BNP Paribas Global Markets. “It is fully aligned with our global strategy aimed at capturing the flows and at partnering with the most prominent platforms aggregating such flows”.

“On behalf of our clients, I am especially pleased to have BNP Paribas as a new issuer on deritrade. Their expertise in the world of structured products, specifically in Autocallable Barrrier Reverse Convertible Certificates, reinforces deritrade’s positioning as a leading digital structured products platform for institutional clients. BNP Paribas, as an established leader in structured products, offers us a truly global reach and prominence in this area and opens possibilities for future expansion and synergies of the platform”, says Roger Studer, Head of Vontobel Investment Banking.

With strong roots anchored in Europe’s banking history, BNP Paribas supports its clients and employees in today’s changing world and has positioned itself as a leading bank in the Eurozone and a prominent international banking institution. Within Global Markets, BNP Paribas’ teams provide customized and innovative investment in equity markets across the globe.

deritrade is one of the leading multi-issuer platforms for tailor-made products in Switzerland. Over the years, deritrade has evolved into an intuitive self-service platform for relationship managers and external asset managers in Switzerland who want to offer their distinct private clientele a sensible choice of tailor-made structured products at transparent and competitive prices with a MiFID II compliant front-to-end-service over the whole product lifecycle. In 2018, over 36’000 individually tailored products with an issuance volume of CHF 6.0 billion (CHF 4.6 billion in 2017) were issued on deritrade.

Vontobel – Media Relations

Peter Dietlmaier

VONTOBEL – MEDIA RELATIONS

+41 58 283 59 30

Urs Fehr

VONTOBEL – MEDIA RELATIONS

+41 58 283 57 90

Investor Relations

Michèle Schnyder

INVESTOR RELATIONS

+41 58 283 76 97

BNP Paribas – Media Relations

Isabelle Wolff

HEAD OF BRAND & COMMUNICATION

+41 58 212 81 10

Laurence Anthony

MEDIA RELATIONS

+41 58 212 97 62

About Vontobel

At Vontobel, we actively shape the future. We create and pursue opportunities with determination. We master what we do – and we only do what we master. This is how we get our clients ahead. As a globally operating financial expert with Swiss roots, we specialize in wealth management, active asset management and investment solutions. We empower our employees to take ownership of their work and bring opportunities to life. Because we are convinced that successful investing starts with assuming personal responsibility. We relentlessly question the achieved, striving to exceed the goals and expectations of our clients. The registered shares of the Vontobel Holding AG are listed on the SIX Swiss Exchange. The Vontobel families’ close ties to the company guarantee our entrepreneurial independence. We consider the resulting freedom an obligation to assume social responsibility as well. As of June 30, 2019, Vontobel held CHF 272.2 billion of total client assets. Around the world and in our home market, we serve our clients from 27 locations.

About BNP Paribas (Suisse) SA

With almost 1,400 employees and 4 establishments in Geneva, Zurich, Basel and Lugano, BNP Paribas (Suisse) SA is a leading European bank in Switzerland for businesses, institutions and private clients. Established in Switzerland since 1872, we are here to develop over the long term, with a specific strategy for each business-line: To be the privileged partner of businesses and institutions, to accompany them in their development in Europe and internationally, with our “One Bank for Corporates” initiative. To be a reference in Wealth Management in terms of expertise and of service for our private clients and entrepreneurs. To be a center of excellence for funding of raw materials thanks to our “Specialized Trade Solutions” offer at the service of our historical customers who share our values, and of the bank’s corporate clients in Europe. The integrated model of the BNP Paribas Group enables us to offer our clients the financial stability of a first rate bank in Europe with international reach and a full range of products and investments. By developing privileged long-term relationships with our customers, we aspire to contribute to sustainable and responsible growth. Since 2015, BNP Paribas is also an active member at the Swiss Structured Products Association SSPA.

- Equal opportunities at every level of the company

- Non-discrimination principles applied

- Over 30% of the employees with an Executive Officer status are women

- Promoting and encouraging values of sharing and innovation.

Diversity and inclusion as our core values

BNP Paribas promotes equal opportunities at every level of the company

As a part of its proactive accountability policy, BNP Paribas promotes equal opportunities at every level of the company. Diversity, inclusion and gender equality are core values that are expressed through tangible initiatives, such as a global commitment to the Women’s Empowerment Principles and a partnership with the HeForShe campaign.

MixCity: a network promoting women at BNP Paribas

MixCity is a BNP Paribas Group-wide initiative that has been rolled out in Switzerland. This association now includes over 70 women entrusted with the mission of promoting and encouraging the feminine values of sharing, cross-functionality, respect and innovation.

Non-discrimination principles applied at every career stage

Trusted criteria and objectives in order to ensure equal treatment

As a responsible employer, the bank draws on trusted criteria and objectives in order to ensure equal treatment, including having at least one woman in final candidate lists and a transparent, justified choice for every decision made, as well as a fixed salary scale for each type of position within the company.

In everyday operations, a healthy work-life balance has been supported through the introduction of remote-working and flexible hours for all employees. The bank upholds a zero-tolerance policy to any attempts to violate personal integrity, as well as an anonymous alert system which was established several years ago.

Employees are also supported as they take on greater responsibility. In Switzerland, over 30% of the employees with an Executive Officer status are women, like CEO Monique Vialatou, who was appointed to her role in the summer of 2018.

MixCity is an association that supports women in their personal and professional development.”

Béatrice Joliot

Meet Béatrice Joliot

Senior Legal Counsel and Director of the MixCity Executive Committee in Switzerland

Beatrice explains the role of a women’s network in a bank, and how it can help to address issues related to equality.

In brief, what is MixCity and how is the network useful in a company like BNP Paribas in Switzerland?

MixCity is an association that supports women in their personal and professional development at BNP Paribas. The network is active on a global scale, and 14 networks have been established since 2009. Switzerland’s association emerged in 2015.

It promotes networking between women, as well as gender equality and the sharing of experiences.

Which themes do you plan to address in 2019?

Although a wide range of topics will be broached throughout the year, two particular themes will be central to our work for 2019: examples of career paths presented by women who are leaders in their field, and “self-marketing”. The latter can help women to assert their value, build up their image and gain recognition for their skills. These workshops and presentations generally take place at informal, women-only lunches in order to create an environment that fosters listening and trust.

Why did you decide to open the network up to men? How can they help to promote equality?

The importance of involving men in the fight for gender equality is becoming increasingly clear, simply because everyone is affected. Discussing these issues with male colleagues gives them a better understanding and allows them to provide better support, in order to work towards more progress and fulfilment at the bank. We need them just as they need us.

Which figure inspires you on a daily basis?

On a daily basis, I’m not sure. However, I am very grateful for the work of the Suffragette movement led by Emmeline Pankhurst, which secured the vote for women.

With three new hires in the second half of 2018 BNP Paribas Global Markets in Zurich is boosting its operations.

Andrea Baumeister, as THEAM Sales Switzerland, Equity Derivatives Group

Marc Leo Schweizer, as Portfolio Solutions Sales Specialist

Pascal Sahli, as Head Institutional Sales Switzerland

He is responsible for cross asset solutions, derivatives and THEAM fund distribution for institutional Clients across Switzerland, including Pension Funds, Insurance Companies, Asset Managers, Discretionary Portfolio Managers and Family Offices. Pascal is based in Zurich, Switzerland while his team is located in Paris and Zurich. Prior to joining BNP Paribas, Pascal was heading the Swiss solutions and equity derivatives business at Bank of America Merrill Lynch as well as the Pension and Insurance Solutions business for Switzerland at Goldman Sachs International in London. Pascal holds a degree from the University of St Gallen, Switzerland.

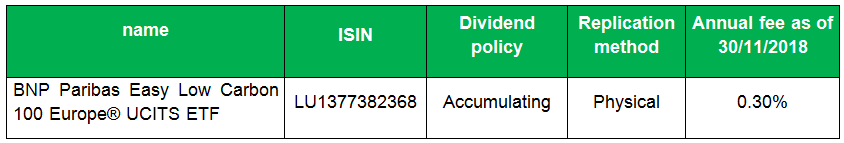

BNP Paribas Asset Management confirms its commitment to low carbon finance on the 10th anniversary of its BNP Paribas Easy Low Carbon 100 Europe® UCITS ETF and strengthens its offer in Switzerland with the listing of this ETF on the SIX Swiss Exchange on 11 December 2018. Launched in October 2008, BNP Paribas Easy Low Carbon 100 Europe® UCITS ETF was the first low carbon fund, offering investors an effective investment solution to reduce the carbon footprint of their investment portfolio. It replicates the Low Carbon 100 Europe® NR, an index created and published by Euronext that contributes to financing energy transition by redirecting investments towards those companies that are most active in reducing their carbon emissions and that offer the products and services required for energy transition to occur. Euronext recently announced the exclusion of fossil fuel companies following its December rebalancing of the index.

ABN AMRO Bank N.V., BNP Paribas and Commerzbank AG were mandated by ECOM Agroindustrial Corp. Ltd. (“ECOM” or “The Company”) to arrange the refinancing of their USD 650m Multicurrency Revolving Credit Facility dated 12th October 2016 and subsequently extended in 2017. The refinancing adds a new 3y RCF (with one 1y extension option) to the existing 1y RCF structure (including three 1y extension options), split USD 216.7m and USD 433.3m respectively. Both tranches include an innovative social impact incentive to interlink ECOM’s social impact objectives and the company’s funding. Any social impact discount received by the Company will be distributed into the ECOM Foundation and ECOM’s Sustainable Management Services division. The ECOM Foundation is a not-for-profit organisation supporting projects in origin producing communities. ECOM’s Sustainable Management Services division is a support function within the Company focused on providing agronomy services and technical assistance to farmers and communities. The social impact incentive was well received by lenders and the transaction closed oversubscribed with subsequent scale back for all lenders. The syndicate comprises 27 banks including 2 new banks, with the following titles:

Bookrunner and Mandated Lead Arranger

- ABN AMRO BANK N.V.

- BNP PARIBAS (SUISSE) SA

- COMMERZBANK AG

- HSBC

- ING

- Natixis

- Rabobank

- RBI

- Zürcher Kantonalbank

Lead Arranger

- Banco do Brasil S.A.

- Deutsche Bank

- KFW Ipex-Bank

- UBS

- UniCredit

Arranger

- Agriculture Bank of China

- Bank of Tokyo-Mitsubishi

- Credit Agricole (Suisse)

- DZ Bank

- Garanti Bank

- KBC Bank

- Nedbank

- OCBC

- Societe Generale

- Wells Fargo

Participant

- BCGE

- BIC-BRED

Since last July 6, Vahram Yerikian is officially Head of Specialized Trade Solutions EMEA for BNP Paribas.